Download the Cost Sheet Template in Excel, OpenOffice Calc, Google Sheets, and PDF for manufacturers and small businesses to define the price of your products.

This template consists of 3 different formats: Simple Cost Sheet for Small Businesses, Cost Sheet with COGS for Manufacturers, and Cost Sheet for Resellers/Traders of Goods.

Managers and decision-making authorities of production units can use this template to determine the product price and for cost management purposes.

Table of Contents

What is a Cost Sheet?

A cost sheet is a statement created at regular periods that totals all the expenses related to a product or production operation.

It is utilized to total the profit margin made on a project or product and serves as the foundation for pricing comparable goods in the future.

Moreover, it displays past data for comparison and the different costs that make up a product’s final cost. The cost sheet can be used to determine a product’s optimal selling price.

Elements of Cost Sheet

A cost sheet consists of 4 major components:

- Prime Cost

- Works Cost

- Cost of Production

- Cost of Sales

Let’s understand each of them in brief.

Prime Costs

Prime costs are any outlays that are directly related to the production process. Also known as a flat, initial, or fundamental cost.

Consider that you own a bakery. The money you spend on raw materials, such as flour sacks, paying employee wages, and other direct production costs, would be your main outlay of funds.

Formula to Compute Prime Costs:

Prime Costs = Direct Labor + Direct Raw Material + Direct Expenses

Work Costs

The sum of prime costs and factory costs or overhead charges is known as the work costs. Overhead expenses are indirect costs such as wages paid to workers who are only partially involved in the manufacturing process and money spent on taxes and utilities.

Cost of Production

You must account for all expenses incurred by your firm, including factory rent and labor costs. To obtain the Cost of Production, we need to subtract work expenses and administrative overhead expenses from the opening and closing stock of Finished Goods.

Cost of Sales

The cost of sales includes all expenses spent during production as well as marketing and distribution overhead. This measure informs you of an item’s overall production value depending on the resources invested in it.

You may determine your profit by calculating the sales price for finished items based on the cost of sales.

What is COGS?

The cost of goods sold is the number of products sold by a retailer, distributor, or manufacturer. It is the amount of money spent by a corporation on labor, materials, and overheads to manufacture/purchase items supplied to customers within the fiscal year.

Formula To Calculate COGS (Cost of Goods Sold)

To Calculate COGS, the formula is as follows:

COGS = Total cost of production + Opening stock of the Finished goods – Closing stock of the finished goods.

Purpose of Cost Sheet

- Set your products’ and services’ optimal cost per unit. You would have solid evidence to support your price selection rather than just making up numbers off the top of your head.

- Keep an eye on your manufacturing expenses to make sure they stay within the market’s competitive range.

- To calculate reasonable profits even when you raise your rates, or provide discounts.

- The cost sheet’s primary goal is to calculate a product’s cost. You may use this sheet to determine the selling price of an item or service. It is essential for every production unit and aids in regulating a product’s cost.

- Furthermore, it aids management in making crucial decisions like keeping or replacing a current machine, changing the design of a product or a raw material, etc.

Methods To Prepare Cost Sheet

You may create a Cost Sheet using Historical Costs and Estimated Costs.

Historical Costs

A Historical Cost sheet contains the actual cost for a previous period. You can compare prices of raw materials, overhead costs, etc with such Historical Cost Sheets.

Estimated Cost

An Estimated Cost sheet contains expenditures before manufacturing begins. A cost sheet like this is important for quoting the tender price of a task or contract. You can create a cost sheet using data from the financial statement.

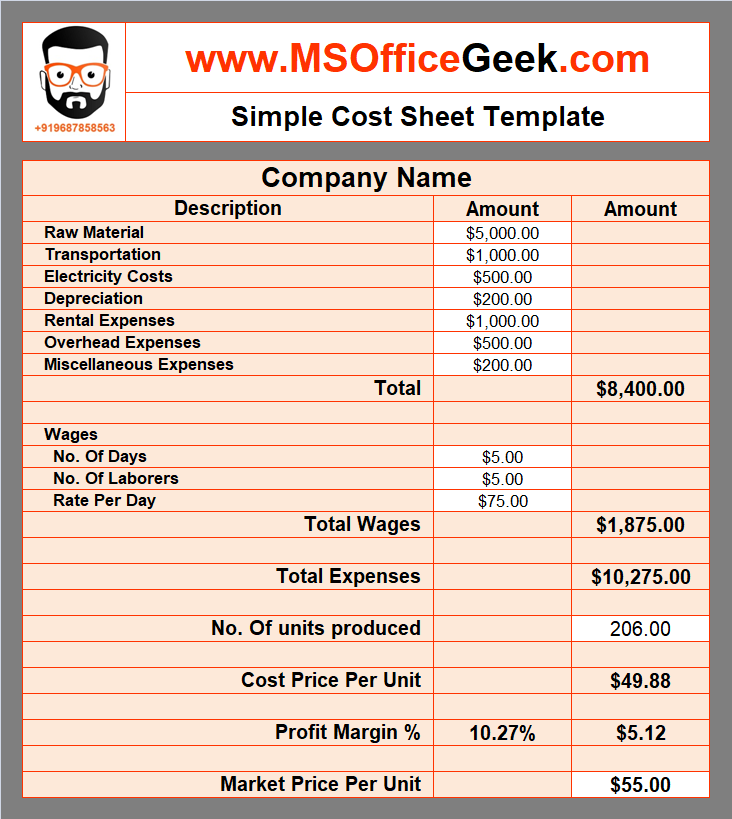

Download Simple Cost Sheet Template (Excel, OpenOffice Calc, Google Sheet & PDF)

We have created a Simple Cost Sheet Template with predefined formulas for small businesses to calculate and manage the prices of their products.

Just insert the amounts in the white cells and it will automatically compute the price along with the profit margin percentage based on market price.

Download by clicking below on the desired format:

Additionally, you can download other Financial Analysis templates like Compound Interest Calculator, Break-Even Analysis Template CAGR Calculator, Income Statement Projection Template, etc.

Moreover, you can also contact us for the customization templates as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

How To Use Simple Cost Sheet Template?

The Simple Cost Sheet Template consists of the following heads:

Raw Material

Transportation

Electricity Costs

Depreciation

Rental Expenses

Overhead Expenses

Miscellaneous Expenses

Wages

No. Of Days

No. Of Laborers

Rate Per Day

No. Of units produced

Cost Price Per Unit

Profit Margin %

Market Price Per Unit

Insert the applicable amounts and the template automatically calculates the totals.

Based on the total number of units produced and estimated selling price, the template will calculate the profit margin percentage for you.

That’s it and your cost sheet is ready.

Printable Simple Cost Sheet Format

Click on the link to download the Simple cost sheet printable format:

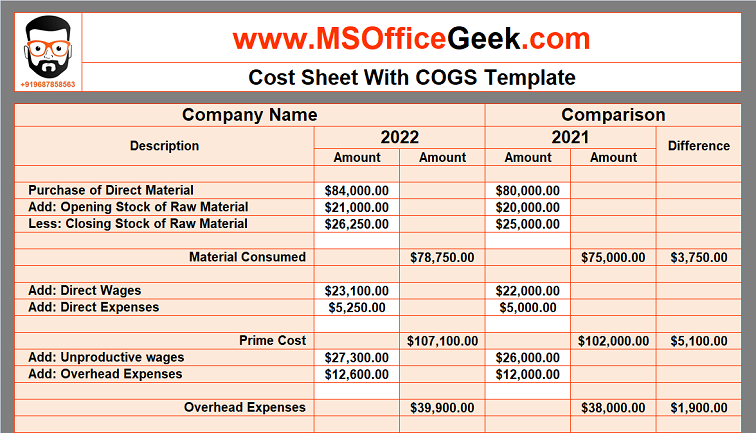

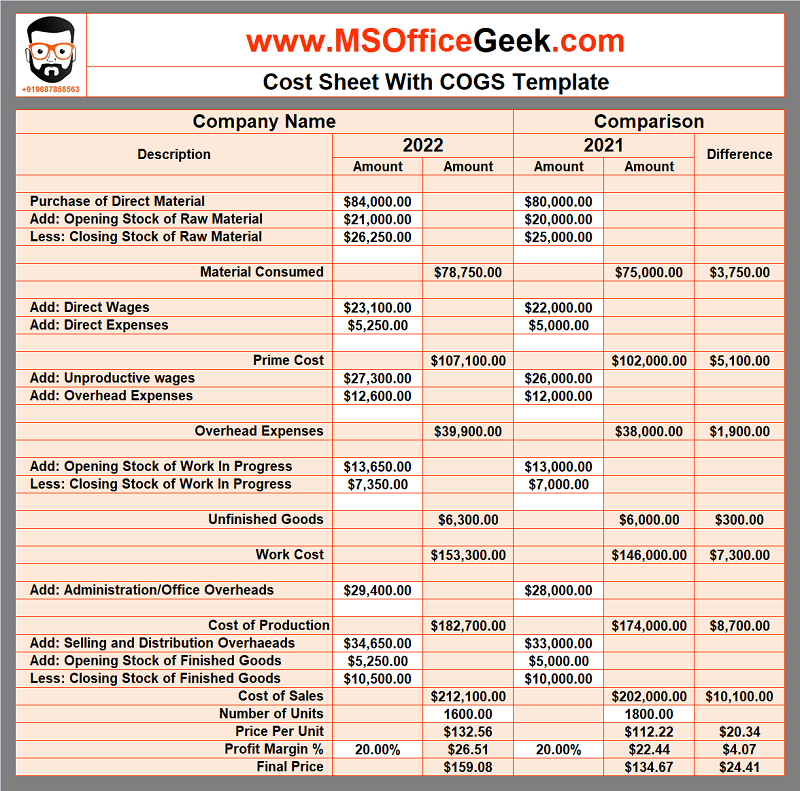

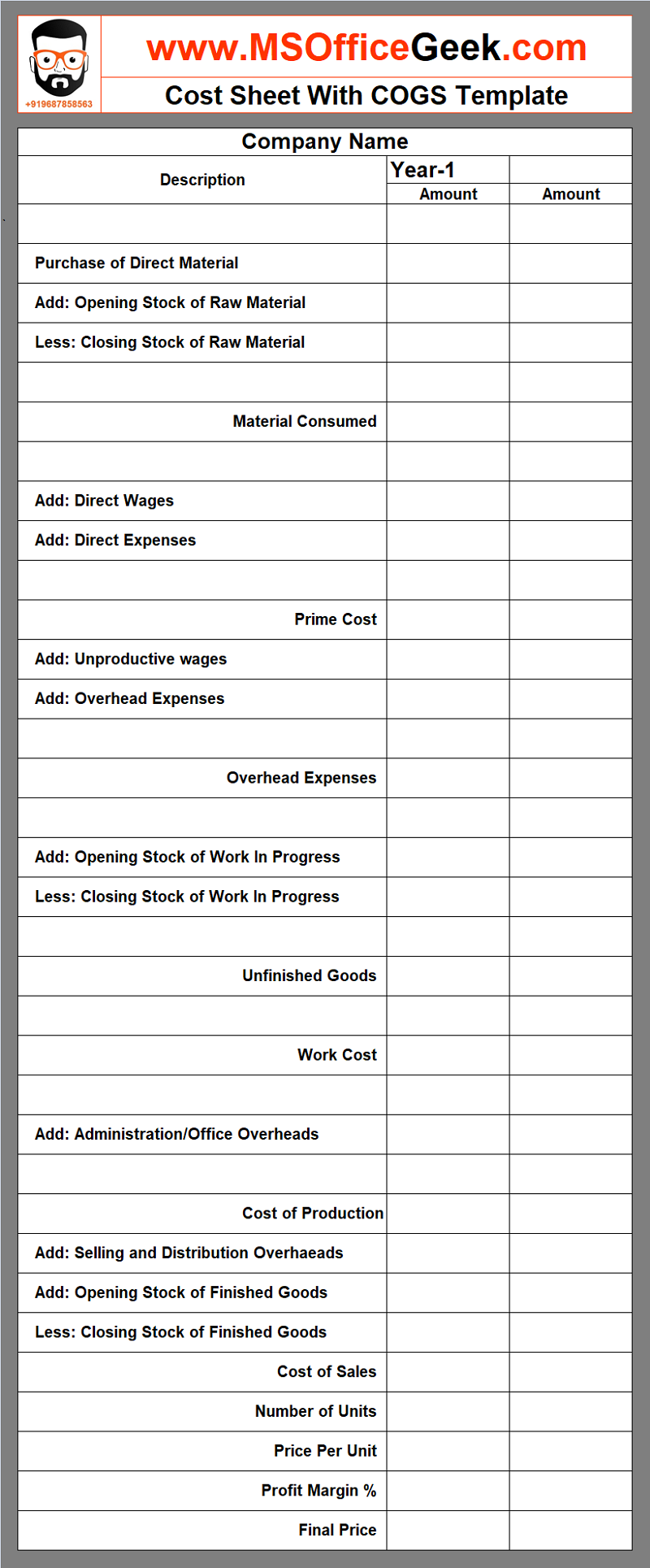

Download Cost Sheet With COGS Template (Excel, OpenOffice Calc, Google Sheet & PDF)

We have created the Cost Sheet With COGS Template with predefined formulas for manufacturing businesses to calculate, compare and manage the prices of their products.

Just insert the amounts in the white cells and it will automatically compute the price along with the profit margin percentage based on market price.

Download by clicking below on the desired format:

How To Use Cost Sheet With COGS Template?

The Cost Sheet Template consists of the following heads:

Purchase of Direct Material

Opening Stock of Raw Material

Closing Stock of Raw Material

Material Consumed

Direct Wages

Direct Expenses

Prime Cost

Unproductive wages

Overhead Expenses

Overhead Expenses

Opening Stock of Work In Progress

Closing Stock of Work In Progress

Unfinished Goods

Work Cost

Administration/Office Overheads

Cost of Production

Selling and Distribution Overheads

Opening Stock of Finished Goods

Closing Stock of Finished Goods

Cost of Sales

Number of Units

Price Per Unit

Profit Margin %

Final Price

Insert the amounts in the white cells and it will automatically calculate the cost price of the product. Insert the profit margin percentage to compute the final price of your product.

The template consists of additional columns to enter the figures of the previous year to compare the cost of each head from the historical period. It displays the difference between the current figures and the historical figures.

Click on the “+” or “-” icon on top of the sheet to hide and unhide these columns.

Printable Cost Sheet Format With COGS

Click on the link to download the Cost Sheet Printable Format:

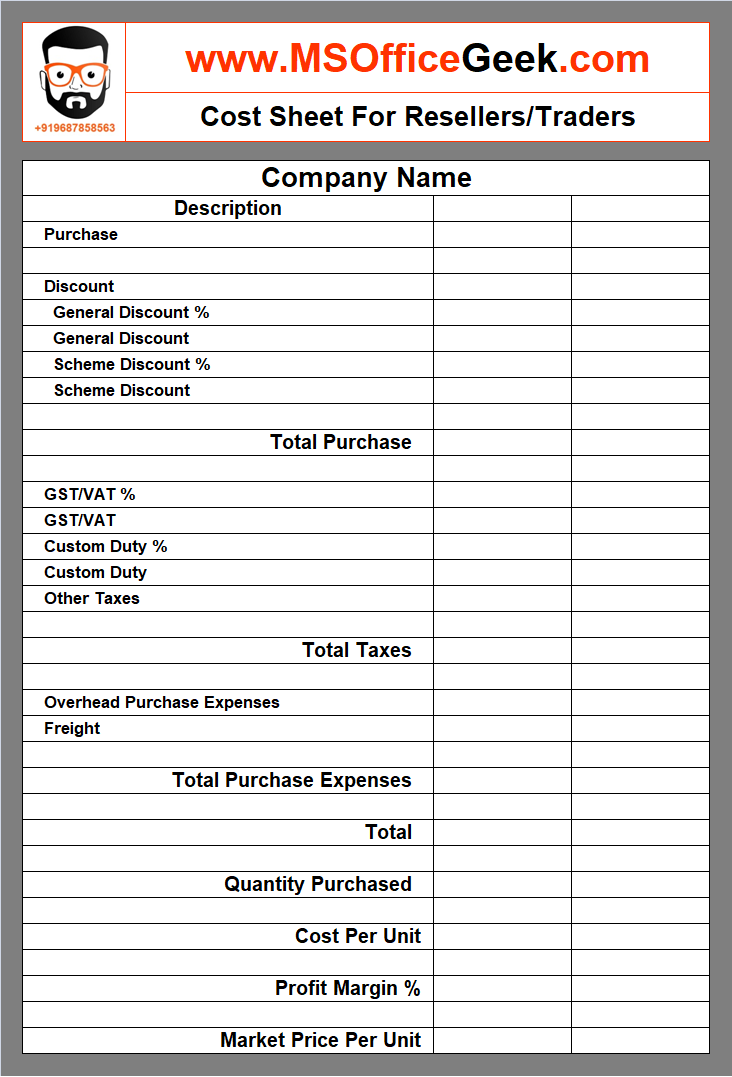

Download Cost Sheet Template For Resellers/Traders (Excel, OpenOffice Calc, Google Sheet & PDF)

We have created the Cost Sheet Template for Resellers/Traders with predefined formulas to calculate, compare and manage the prices of their products.

As traders don’t produce goods, they have other types of expenses involved to calculate the price of the product.

Just insert the amounts in the white cells and it will automatically compute the price along with the profit margin percentage based on market price.

Download by clicking below on the desired format:

How To Use Cost Sheet Template for Resellers/Traders?

The Cost Sheet For Resellers/Traders consists of the following heads:

Purchase

Discount

General Discount %

General Discount

Scheme Discount %

Scheme Discount

Total Purchase

GST/VAT %

GST/VAT

Custom Duty %

Custom Duty

Other Taxes

Total Taxes

Overhead Purchase Expenses

Freight

Total Purchase Expenses

Total Costs

Quantity Purchased

Cost Per Unit

Profit Margin %

Market Price Per Unit

Resellers, Distributors, and traders get a general discount on the price of the product. They are sometimes also entitled to scheme discounts. These scheme discounts help the seller to sell more goods and it also increases the profit for distributors/resellers.

Insert the amounts in the white cells and it will automatically calculate the cost price of the product. It also calculates the profit margin percentage and profit per unit when you enter the market/final price of the product.

Printable Cost Sheet Format For Resellers/Trader

Click on the link to download the Cost Sheet For Resellers Printable Format:

Frequently Asked Questions

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.