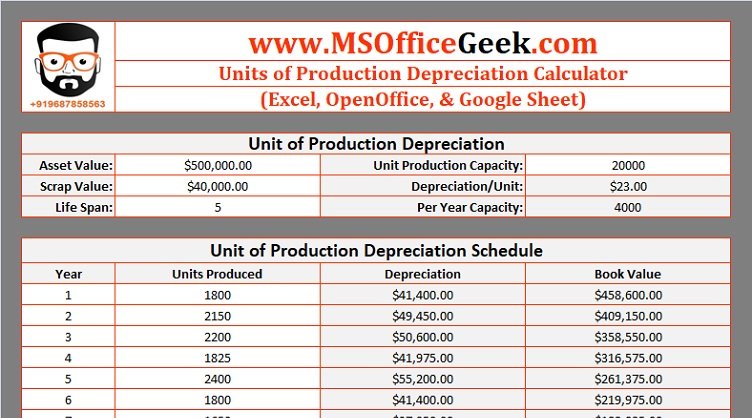

Units Of Production Depreciation Calculator Template in Excel, OpenOffice Calc & Google Sheet to depreciate an asset on production capacity.

Additionally, this template calculates the applicable depreciation per unit as well as production capacity per year. It also provides the Depreciation Schedule for the life span of the asset against units produced during that year.

Table of Contents

Units of Production Depreciation – Definition

Units of Production Depreciation is another depreciation method to calculate depreciation based on usage of the asset. In simple terms, it is calculated based on the lifetime production capacity of an asset.

Commonly, manufacturing businesses use this method. Depreciation under this method varies in proportion to the total units the machinery or equipment produces each year.

Moreover, this method takes into consideration the actual wear and tear of the asset/equipment. As production increases or decreases, the amount of depreciation also increases and decreases.

Similarly, this applies to the seasonality of the business as production fluctuates with consumer demand. This method is beneficial for any business where the loss of value is directly related to production.

Formula To Calculate Depreciation Per Unit

Depreciation Per Unit = (Cost – Scrap Value) / Total Production Capacity (Units)

Where:

Cost = Purchase price + Addtional costs incurred on asset to acquire and run.

Salvage Value = The estimated value of asset at the end of the life span.

Total Production Capacity (Units) = Number of units the equipment or machinery can produce during its life span.

Formula To Calculate Units of Production Depreciation

Unit of Production Depreciation = Depreciation Per Unit X Actual Units Produced

Therefore, you need to multiply the depreciation per unit with actual units produced during that particular year.

Download Units of Production Depreciation Calculator (Excel, OpenOffice Calc & Google Sheet)

We have created a simple and easy Units of Production Depreciation Calculator with predefined formulas and functions. Just insert a few details and it will prepare the depreciation schedule for the given asset.

Download your desired format and start using it.

Additionally, you can download other accounting templates like Sum of Years Depreciation Calculator, Straight-Line Depreciation Calculator, Declining Balance Depreciation Calculator, Profit & Loss Statement Template, and Balance Sheet Template, etc.

Moreover, you can download other HR templates like Payroll Template With Attendance, Salary Slip Excel Template India, Simple Salary Sheet, and Employee Salary Sheet depending on the company requirement.

Feel free to contact us for the customization of this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

Contents of Units of Production Depreciation Calculator

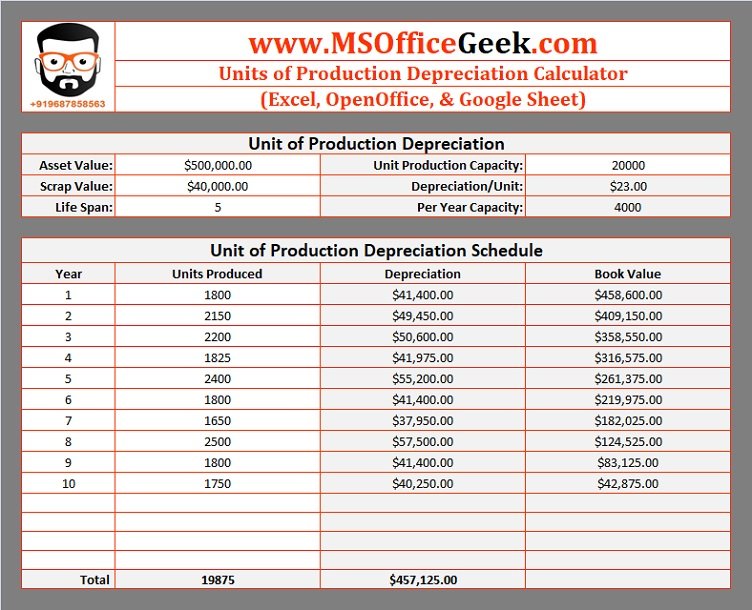

Units of Production Depreciation Calculator consists of two sections: Data Input Section and Depreciation Schedule. Let us understand each section in detail.

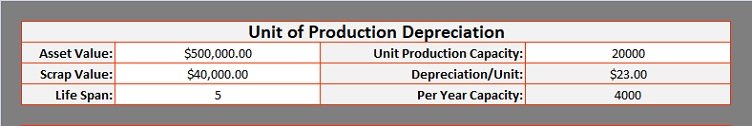

Data Input Section

The data input section consists of the following heads:

Asset Value

Scrap Value

Life Span

Unit Production Capacity

Depreciation/Unit

Per Year Capacity

Enter the cost of the asset other additional costs incurred to make it functional. Salvage value is the end value of an asset after the life span is over. Life span is the number of years an asset is expected to work.

Insert estimated production capacity in terms of units of the asset during the life span. The template automatically calculates the depreciation per unit and estimated production capacity per year.

Moreover, the depreciation changes every year as it is calculated based on actual units produced.

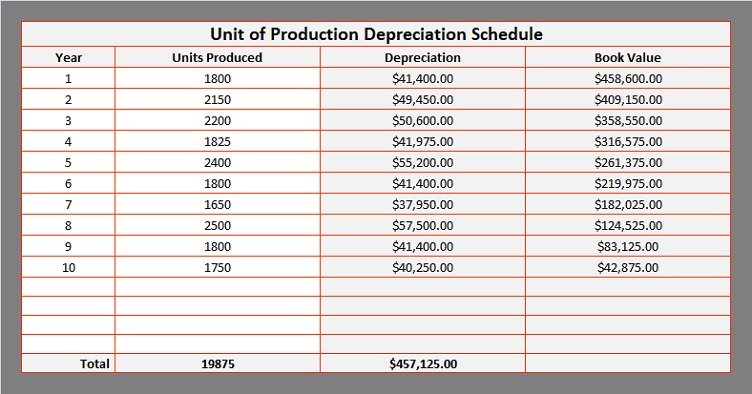

Units of Production Depreciation Schedule

To prepare the depreciation schedule, you need actual units produced every year. Rest all is auto-calculated.

This section consists of four columns:

Year

Units Produced

Depreciation

Book Value

Insert sequence of years based on life span and insert the units produced during the respective year. Thus, it multiplies per unit depreciation with the number of units produced.

Moreover, it displays the book value of the asset after deducting the depreciation for each year.

Advantages of Units of Production Depreciation Method

- Calculates depreciation proportionate to the usage of assets.

- Reflects actual wear and tear on the asset.

- As it matches revenues and expenses, it provides a realistic view of the business.

- Simple and easy to calculate.

Disadvantages of Units of Production Depreciation Method

- Not acceptable by IRS and almost all governments for tax purposes.

- For tax purposes, you need to maintain a separate set of books for Accounting.

- As depreciation is based on production, you need to calculate it every year.

- More chances of human error in defining the units of production.

- You cannot charge depreciation when the asset is not in use.

Journal Entries for Units of Production Method

There are different entries at different stages.

Journal Entry at Purchase of Asset

Asset Account – Debit

Cash, Bank, or Creditor Account – Credit

Journal Entry at Depreciation

Depreciation Account – Debit

Asset Account – Credit

Journal Entry at the end of the year

P&L Account – Debit

Depreciation Account – Credit

At the end of the accounting period, the Balance sheet reflects the Book Value of the asset which is decreased by the amount of depreciation every year.

Frequently Asked Questions

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.