MSME Payment Rules 2024 have been in talks after the 2024 amendment of MSME ACT Central Government. We have tried to all relevant rules and regulations in simple language.

Moreover, there has been a change to Income Tax Rules and the addition of Section 43(b) for making payments to MSMEs. These changes will have a huge impact on the currently running businesses that have been indulged in bigger payment cycles like 90 days or even 120 days.

On the contrary, this move of government is going to help MSMEs to gain stability and increase the flow of cashflow.

Here are some clarifications about the MSME Payment Rules 2024, let’s discuss them in detail.

This extremely useful article was voluntarily contributed by Kirti Tiwari, MBA Finance, Gold Medalist.

Table of Contents

Section 15: Liability of buyer to make payment

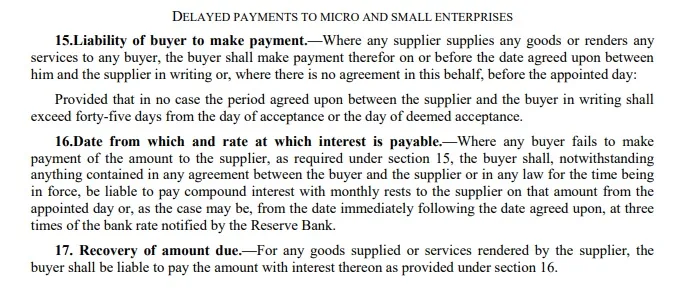

As per Section 15 of the MSME Act:

“On or before the agreed date: If the buyer and supplier have a written agreement specifying a payment date, that date holds.

Before the appointed day: If there’s no written agreement on the payment date, the buyer must pay by the “appointed day.” This legal term likely refers to a standard payment deadline defined in the relevant law.

Within 45 days: Even with a written agreement, the payment deadline cannot exceed 45 days from the day the buyer accepts the goods or services (or is legally considered to have accepted them).”

The above section can be summarized as:

- If there is an agreement: Agreement date or 45 Days Whichever is Earlier.

- If there is no Agreement: 15 Days (Appointed date is defined as 15 days in section 2(b) of the MSMED Act, 2006)

Example

To download a copy of the MSME ACT with recent Amendments in Interim Budget 2024, click the button below:

Now the question is what if any buyer fails to make payment of the amount to the supplier?

Section 16: Date from which and rate at which interest is payable

In simpler terms, if a buyer doesn’t pay a supplier on time, they owe interest on the amount from the date it was due. This interest is calculated monthly and is three times higher than the current bank rate set by the Reserve Bank.

Here’s a breakdown:

Interest starts: From the due date or an agreed-upon date if different.

Calculation: The interest is compounded monthly, meaning it’s calculated on both the original amount and the accumulated interest from previous months.

Rate: Three times the current bank rate set by the Reserve Bank.

This is a penalty for late payments and encourages buyers to pay on time.

If payments are not made to the MSME during the time limit then interest is payable @ 3 times the bank rate notified by RBI.

Currently, the bank rate is 6.75% declared by RBI which can be viewed at https://rbi.org.in/home.

Section 17: Recovery of the amount due.

This section accurately summarizes the buyer’s financial responsibility in this situation.

The buyer owes:

- The full cost of the goods or services: This includes the base price agreed upon between the buyer and supplier.

- Any applicable interest: If the buyer fails to pay on time, they are liable to pay interest on the outstanding amount, as detailed in Section 16.

Source: https://www.indiacode.nic.in/

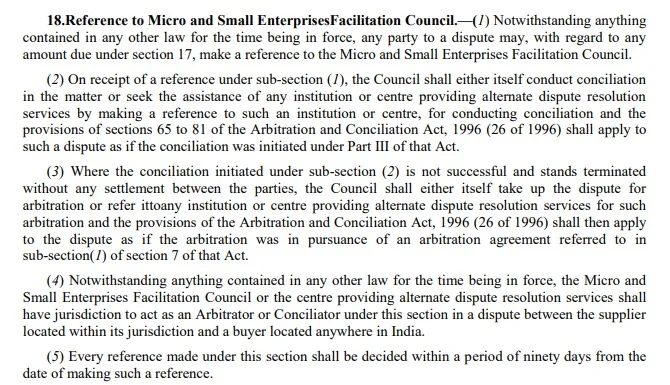

Section 18: Reference to Micro, Small, and Medium Enterprises Facilitation Council

This excerpt describes the role of the Micro, Small, and Medium Enterprises Facilitation Council (MSEFC) in resolving disputes between Micro, Small, and Medium Enterprises (MSMEs) and other parties:

1. Dispute Resolution:

Either party to a dispute involving unpaid dues (as per Section 17) can approach the MSEFC for assistance.

2. Conciliation:

The MSEFC will attempt to mediate the dispute first, either directly or by involving other organizations specializing in alternative dispute resolution (ADR).

During conciliation, both parties have a chance to reach a mutually agreeable solution.

3. Arbitration:

If conciliation fails, the MSEFC can arbitrate the dispute itself or refer it to another ADR provider.

Arbitration involves a neutral third party issuing a binding decision on the dispute.

4. Jurisdiction:

The MSEFC (or the chosen ADR provider) has the authority to handle disputes where the supplier is within its jurisdiction, regardless of the buyer’s location in India.

5. Time limit:

Any dispute referred to the MSEFC must be resolved within 90 days of filing

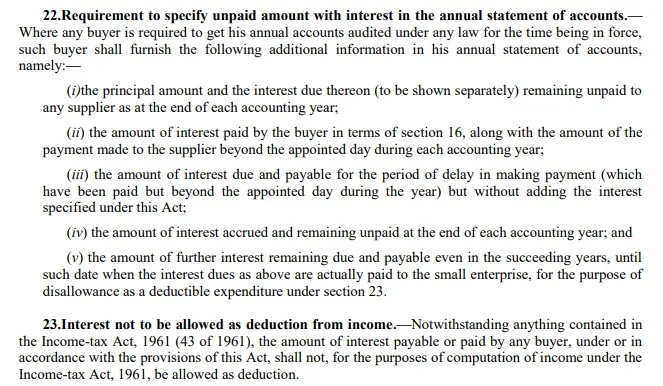

Section 22: Requirement to specify unpaid amount with interest in the annual statement of accounts

This section outlines additional information required in a buyer’s annual statement of accounts if they are legally required to be audited. This information is relevant to transactions with micro, small, and medium enterprises (MSMEs).

1. Unpaid amount details:

Principal amount: The total cost of goods or services owed to the MSE supplier.

Interest due: The accumulated interest on the unpaid amount (shown separately).

As of: This information is required for the end of each accounting year.

2. Payments beyond the due date:

Interest paid: The total interest paid to the MSE supplier as per Section 16.

Payments made: The total amount paid to the MSE supplier after the appointed day (legal due date).

3. Interest paid (excluding penalty):

This refers to interest paid late but within the same year, excluding the penalty interest mentioned in the Act.

Source: https://www.indiacode.nic.in/

Section 23. Interest is not to be allowed as a deduction from income

This section deals with the tax implications for buyers who pay interest on late payments to Micro, Small, and Medium Enterprises (MSMEs) as per this Act.

Here’s a simplified explanation:

Interest paid on late payments to MSMEs cannot be deducted from the buyer’s income when calculating their taxable income under the Income Tax Act, of 1961. This means interest is non-deductible, meaning it increases the overall tax liability for the buyer.

Income Tax Implications of New MSME Payment Rules 2024

Due to the new amendments in the Payment Rules of MSME 2024, there have been many implications for businesses.

Trader’s Inclusivity in MSME

Traders are not covered under Section 43B(h) of the Income Tax Act, 1961. Wholesale and retail traders are allowed to register on the Udyam Registration Portal and be recognized as MSMEs, the benefits they receive are limited to Priority Sector Lending.

This implies that they are not eligible for other benefits associated with MSME status, including the provisions of Section 43B(h).

Therefore, only manufacturers and service providers qualify for the benefits of Section 43B(h), which allows buyers to claim deductions for payments made to these MSMEs within the stipulated timeframe as defined by the Micro, Small and Medium Enterprises Development Act, 2006.

Disallowance under Section 40(a)(ia) and 43B(h) Simultaneously

Two sections in the Income Tax Act disallow the claim. Let’s have a brief understanding of that.

Section 43B(h):

This section disallows the deduction of any expense incurred for purchases made from registered micro and small enterprises (MSEs) if the payment is not made within the timeframe prescribed under the Micro, Small, and Medium Enterprises Development Act, 2006.

Section 40(a)(ia)

This section disallows the deduction of any expenditure if the payment for that expenditure is not made within the prescribed time limit as per the Income Tax Act. This applies irrespective of whether TDS is deducted or not.

Hurdles and Losses for Buyers Due to Delayed Payments to MSMEs

- Disallowance under Section 43B(h) of the Income Tax Act: If the payment is not made within the stipulated timeframe, the buyer cannot claim a deduction for the expense incurred with the purchase from the MSME. This can significantly increase the buyer’s taxable income and lead to higher tax liability.

- Interest Payment: As per the MSMED Act, buyers are liable to pay compound interest with monthly rests on the outstanding amount to the MSME at three times the bank rate notified by the Reserve Bank of India. This can result in a substantial financial burden for the buyer.

- Penalty under Section 23 of the MSMED Act: The interest paid or payable on delayed payments to MSMEs is considered penal and disallowed as an expense deduction under the Income Tax Act.

Applicability to businesses filing Income Tax Returns (ITRs) under Section 44AD or 44ADA

NO, Section 43B(h) does not apply to businesses filing Income Tax Returns (ITRs) under Section 44AD or 44ADA.

Reasons For Non-Applicability of Section 43B(h)

- Sections 44AD and 44ADA of the Income Tax Act, 1961, are presumptive taxation schemes. These schemes allow eligible small businesses to calculate their taxable income based on a predetermined percentage of their turnover rather than following the regular method of maintaining detailed financial records and claiming deductions for expenses.

- These presumptive schemes are considered overriding provisions. This means that they supersede the regular provisions for calculating income and expenses as outlined in Sections 28 to 43C of the Income Tax Act.

- Section 43B(h) falls within the scope of sections 28 to 43C. It deals with the disallowance of deductions for expenses incurred if payments to suppliers are not made within a stipulated timeframe.

- Since sections 44AD and 44ADA override sections 28 to 43C, they also override the provisions of Section 43B(h). Therefore, businesses opting for these presumptive schemes are not subject to disallowance under Section 43B(h) even if they delay supplier payments.

Applicability to Businesses With A Turnover Upto ₹10 crores With No Tax Audit

Even if a business with a turnover of up to ₹10 crores is not subject to a tax audit, Section 43B(h) of the Income Tax Act, 1961, still applies.

Here’s Why:

Tax Audit vs. Section 43B(h): Tax audits are mandatory for businesses exceeding a certain turnover threshold to ensure proper accounting and tax compliance. However, Section 43B(h) is a separate provision that deals specifically with the disallowance of deductions for expenses incurred if payments to registered micro and small enterprises (MSEs) are not made within the stipulated timeframe as defined by the Micro, Small, and Medium Enterprises Development Act, 2006.

Applicability of Section 43B(h): This section applies to all businesses, regardless of their turnover or audit requirement. So, even if a business with a turnover below ₹10 crores is not subject to a tax audit, it must still comply with Section 43B(h) provisions to avoid potential disallowance of expenses related to delayed payments to MSMEs.

Obligation In Case of 50% Payments To MSMEs

As a buyer, purchase goods or services from a registered micro or small enterprise (MSME) and pay 50% of the total amount on time but delay the remaining 50% payment beyond the stipulated timeframe specified in the Micro, Small, and Medium Enterprises Development Act, 2006 (MSMED Act).

Disallowance for delayed portion: The business must make the 50% payment within the stipulated timeframe; failure to do so will result in the disallowance of the deduction from taxable income under Section 43B(h).

Allowance for timely portion: As a Business, you can deduct the 50% payment made on time from your taxable income.

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.

Disclaimer: This article is for educational purposes only and shall not be considered as tax advice. Kindly consult a CA or tax consultant.