Download GST Credit Note Format in Excel, OpenOffice Calc, Google Sheet, and PDF format for Goods Return or Overbilling under GST Regime.

This template consists of an Auto-numbering system. Thus, you can easily manage the sequence of credit notes. It also consists of Credit Note Register which records credit notes issued during the month.

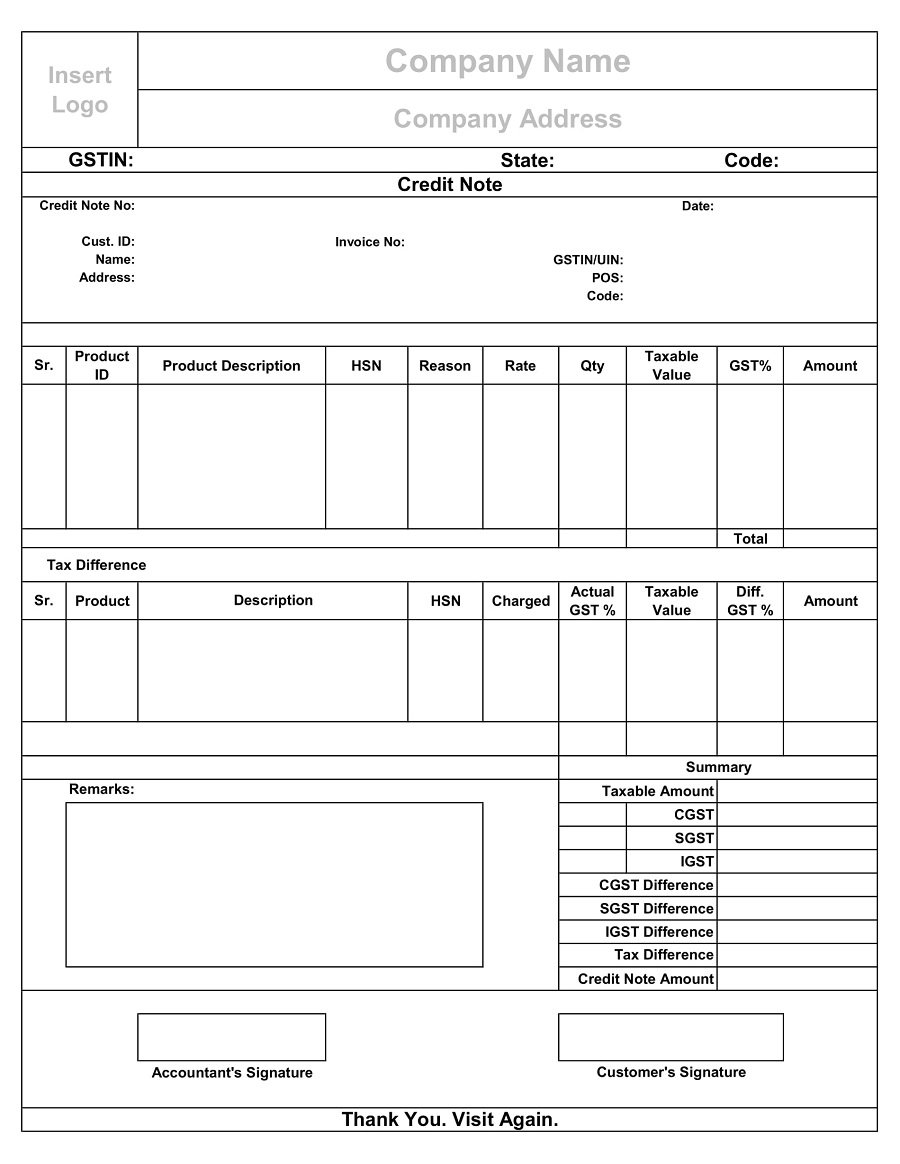

Moreover, you can record goods return as well as excess or less tax collection separately in this credit note. It also consists of a Printable Credit Note Format.

Table of Contents

What Is GST Credit Note?

When the taxable value or tax charged in the original invoice exceeds the taxable value or tax due in compliance with such supply, a registered supplier must issue a GST Credit Note to his client. In other words, when a previously issued invoice has been overcharged.

Moreover, a credit note is issued when the consumer returns the products in exchange for a refund on the invoice.

Section 34(1) of CGST Act 2017 Rules for Issuing a Credit Note Under GST Regime

Conditions to Issue GST Credit Note

As per the GST law, during trade or commerce, after the invoice has been issued there could be situations like:

- The supplier has erroneously declared a value that is more than the actual value of the goods or services provided.

- The supplier has erroneously declared a higher tax rate than what is applicable for the kind of goods or services or both supplied.

- The quantity received by the recipient is less than what has been declared in the tax invoice.

- The quality of the goods or services or both supplied is not to the satisfaction of the recipient thereby necessitating a partial or total reimbursement on the invoice value.

- Any other similar reasons.

To regularize these kinds of situations, the supplier is allowed to issue what is called a credit note to the recipient. Once the credit note has been issued, the tax liability of the supplier will reduce.

Source: www.cbic.gov.in

Contents of GST Credit Note Under CGST Law 2017

Source: www.cbic.gov.in

Download GST Credit Note Format (Excel, OpenOffice Calc, & Google Sheets)

Keeping in mind the rules mentioned above, we have created a GST Credit Note Template with predefined formulas and functions. This template helps issue a GST compliant Credit Note and maintain records of credit notes issued.

Download by clicking below on the desired format:

For regular GST businesses, you can download the Fully Automated GST Invoice Template from the link below:

Additionally, you can download GST templates like GST Payable Calculator, GST Compliant Inventory Template, Bill of Supply Format Under GST, and Payroll Template With Attendance.

Furthermore, feel free to contact us for the customization of this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

How to Use GST Credit Note Template?

- Insert data in all the sections of the Setup File.

- Go to GST Credit Note Template.

- Select Customer ID, and Insert Invoice Number.

- Insert details of returned goods or price differences.

- Enter CGST, SGST, or IGST Tax difference if applicable.

- Insert Remarks, if any.

That’s it. Your GST Credit Note is ready to print.

Components of GST Credit Note Format

This template consists of 4 sheets: Setup File, GST Credit Note Template, Credit Note Register, and Printable GST Credit Note Format.

Let us understand the working of each file in detail.

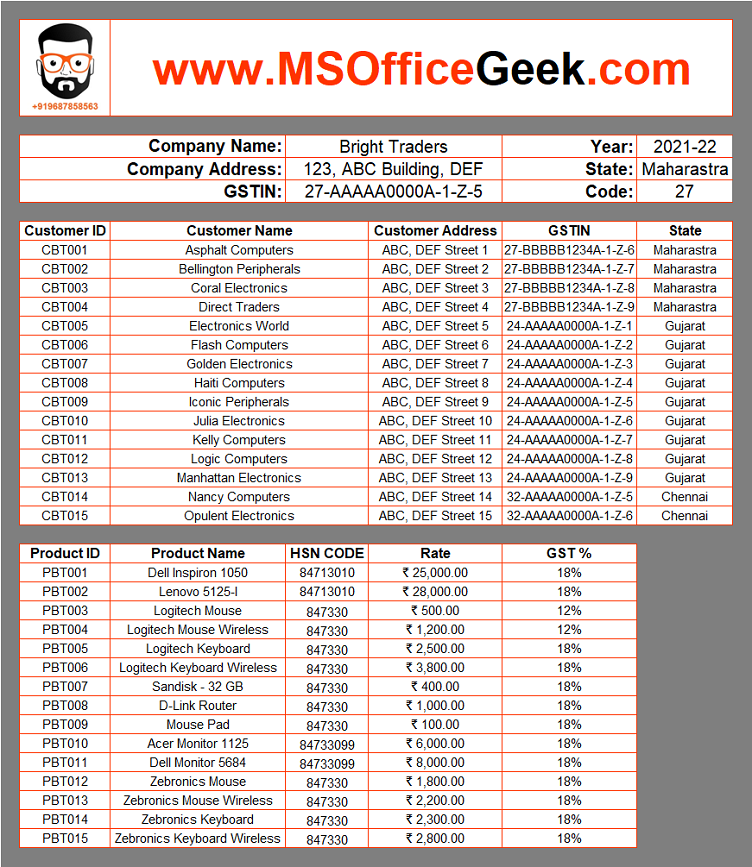

Setup File

The purpose of this file is to insert one-time data to save you time while issuing a GST Credit Note. It consists of the 3 sections: Supplier Information, Client Information, and Product Information.

Supplier information consists of the following:

Company Name

Supplier Address

GSTIN

Financial Year

State

Code

Customer Information consists of the following columns:

Customer ID

Client Name

Client Address

GSTIN

POS

POS is the state in which the customer/buyer is located.

The Product Information section includes the following:

Product ID

Product Name

HSN Code

Price/Rate per Unit

GST Rate

You can pre-define everything in this sheet and the GST Credit Note template automatically fetches the data from this sheet.

GST Credit Note Template

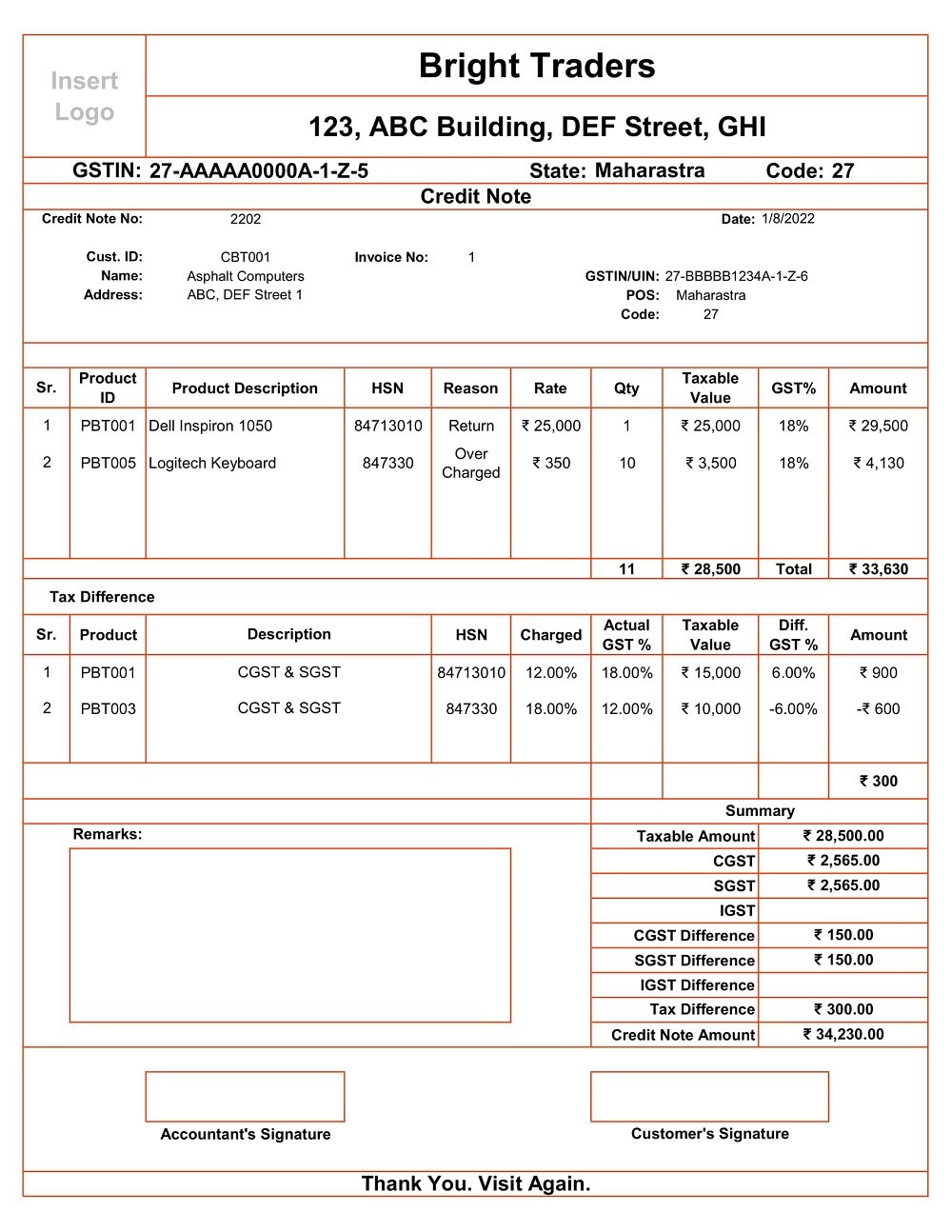

This sheet consists of 5 sections: Supplier Information, Customer Information, Product Information, Tax Difference information, and Other Information.

Supplier Details

Supplier information like company name, company address, GSTIN, State, and Code are auto-populated based on details entered in the setup file. As per the rules, the invoice consists of the heading “Credit Note”.

Customer Details

In the Customer Information Section, insert the Credit Note number only for the first time. It should be 4 digit number. Later it will automatically generate the next number.

Moreover, select customer ID from the dropdown list and it auto-updates all of the following details:

Customer Name

Customer Address

GSTIN

POS

Code

Insert Code and Original Invoice number manually.

Product Details

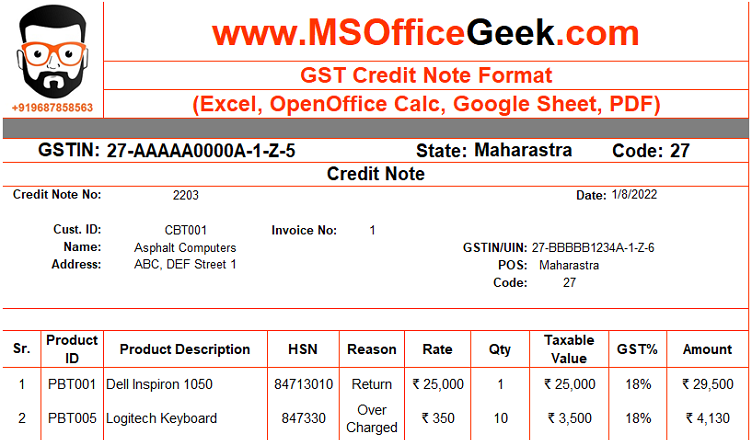

Furthermore, the Product Information section consists of the following columns:

Sr.

Product ID

Product Description

HSN

Reason

Rate

Qty

Taxable Value

GST%

Amount

The serial number is auto-populated. Select product ID and it fetches Product description and HSN. Insert rate per unit, reason, and quantity manually. If the goods are returned then insert full rate otherwise insert the rate difference.

Taxable Value, GST%, and AMount columns are auto-populated.

Tax Difference Section

This section consists of the following Columns:

Sr.

Product Description

HSN

Charged

Actual GST %

Taxable Value

Diff. GST %

Amount

When the wrong tax percentage is charged in the original invoice then it needs to be displayed separately as per the law.

Hence, Insert the wrong % in the “Charged” column and the Actual GST % in the “Actual” column. Rest all columns are auto-populated.

Other Information

The summary section displays the summary of the Credit Note. If the credit Note is an Intra-state it displays CGST and SGST calculations. Whereas, if the Credit Note is Inter-state, then it displays IGST calculations.

The other information section includes the “Remarks” section, signature section, and other miscellaneous details. Moreover, the summary section also consists of Tax Difference where CGST difference, SGST Difference, and IGST Differences are displayed.

Click on the print button and the Credit Note will open the Save as PDF dialog box.

Once you execute the command the Credit Note number will automatically jump to next in the sequence.

Credit Note Register

After you issue the GST Credit Note, it is necessary to maintain client-wise records of the credit note as per the GST Law. Hence, we have created a Credit Note register to record your credit notes.

This sheet consists of the following details:

Date

Credit Note No.

Customer ID

Customer Name

GSTIN

State

Taxable Value

CGST

SGST

IGST

CGST Difference

SGST Difference

IGST Difference

Total Amount

Insert date and credit note number. Select the customer ID and it will fetch other customer-related details like GSTIN, and state. Enter the Taxable Value.

Moreover, insert the amount of CGST and SGST, or IGST, whichever is applicable. The Total amount column is auto-populated.

Additionally, you can generate client-wise, date-wise, and location-wise billing statements using the “Filter” option.

Printable GST Credit Note Format

Moreover, click on the image to enlarge and print the Printable GST Credit Note Format or Click on the button below to download as PDF:

Frequently Asked Questions

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.