Download MAGI Calculator 2024 in Excel, OpenOffice Calc, and Google Sheets to calculate Modified Adjusted Gross Income for Federal Income tax purposes.

With the help of this template, you can calculate both AGI and Modified AGI.

Moreover, the IRS determines the eligibility of Roth IRA contributions and other IRA deductions based on your MAGI. Moreover, MAGI also determines eligibility for several tax credits.

Table of Contents

What is Modified AGI?

MAGI stands for Modified Adjusted Gross Income. You cannot find the Modified Adjusted Gross Income Calculator (MAGI) on your tax returns. Our tax return displays our Adjusted Gross Income Calculator (MAGI) on line 11.

We can calculate the Modified Adjusted Gross Income Calculator by adding back some of the allowed deductions into AGI(Adjusted Gross Income).

The IRS decides the eligibility of several tax credits and IRA contributions based on MAGI. It also defines the amount of deduction we can obtain for our IRA Contributions.

Uses of Modified Adjusted Gross Income Calculator (MAGI)

MAGI is used to determine:

- Traditional IRA Deduction.

- Eligibility for Roth IRA Contribution.

- Eligibility for Tax Credit like Child Tax Credit and premium tax credit.

- Student loan interest deduction.

- Eligibility for income-based Medicaid coverage or health insurance subsidies.

Formulas To Calculate Modified Adjusted Gross Income Calculator (MAGI)

There are different formulas to calculate MAGI or Modified Adjusted Gross Income based on purpose.

To Calculate MAGI For IRA Contributions and Deductions

MAGI = Adjusted Gross Income + Student Loan Interest Deduction + Foreign Earned Income and Housing exclusions + Foreign Housing Deduction + Excluded Savings Bond Interest + Excluded Employer Adoption Benefits.

Formula To Calculate MAGI For Net Investment Income Tax

MAGI = Adjusted Gross Income + Foreign Earned Income exclusions + Adjustment from Form 8960

To Calculate MAGI For IRA Premium Tax Credit

MAGI = Adjusted Gross Income + Foreign Earned Income exclusions + Tax-free interest + Non-taxable Social Security benefits.

Formula To Calculate MAGI For Education Credits

MAGI = Adjusted Gross Income + Foreign Earned Income and Housing exclusions + Foreign Housing Deduction + Excluded income from bona fide resident of Puerto Rico or American Samoa

Formula To Calculate MAGI For Child Tax Credit

MAGI = Adjusted Gross Income + Foreign Earned Income and Housing exclusions + Foreign Housing Deduction + Excluded income from bona fide resident of Puerto Rico or American Samoa

Download MAGI Calculator 2024 (Excel, OpenOffice Calc & Google Sheets)

We have created a simple and easy-to-use MAGI Calculator 2024 with predefined formulas and functions. Just insert the applicable amounts and it will calculate the MAGI for you.

Download by clicking below on the desired format:

Additionally, you can also download Federal Income Tax templates like Adjusted Gross Income Calculator 2024, Itemized Deduction Calculator 2024, Federal Income Tax Calculator 2024, Paycheck Calculator, and IRS Compliant Mileage Log Template.

Furthermore, feel free to contact us to customize this template according to your requirements. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

How To Use MAGI Calculator 2024?

This template consists of 2 calculators: Modified Adjusted Gross Income Calculator and AGI Calculator.

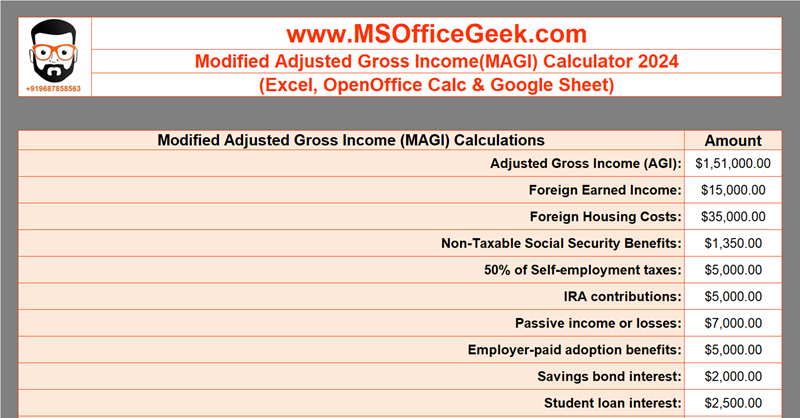

Modified Adjusted Gross Income Calculator (MAGI) Calculator 2024

If you already know your AGI amount then enter it directly. After entering the AGI figures enter the applicable amounts. Based on your purpose of MAGI, enter the respective amounts. Formulas for each purpose are given above.

This section consists of the following heads:

Adjusted Gross Income (AGI)

Foreign Earned Income

Foreign Housing Costs

Non-Taxable Social Security Benefits

50% of Self-employment taxes

IRA contributions

Passive income or losses

Employer-paid adoption benefits

Savings bond interest

Student loan interest

Qualified tuition expenses and fees

Puerto Rico income and or American Samoa resident’s income

Rental Losses

Losses from publicly-traded partnership AGI

All the above-listed line items are special deductions. Special deductions include student loan deductions, Deductions of IRA contributions, foreign income, deductions of foreign housing, adoption expenses, and deductions for higher education costs.

The last row displays your Modified Adjusted Gross Incom(MAGI).

For IRA Eligibility, click on the IRS link below:

Income ranges for determining IRA eligibility change for 2024

If you don’t know your Adjusted Gross Income, you can use the AGI calculator inside the MAGI Calculator.

To open the AGI Calculator, click the “+” on the left-hand side beside the row numbers.

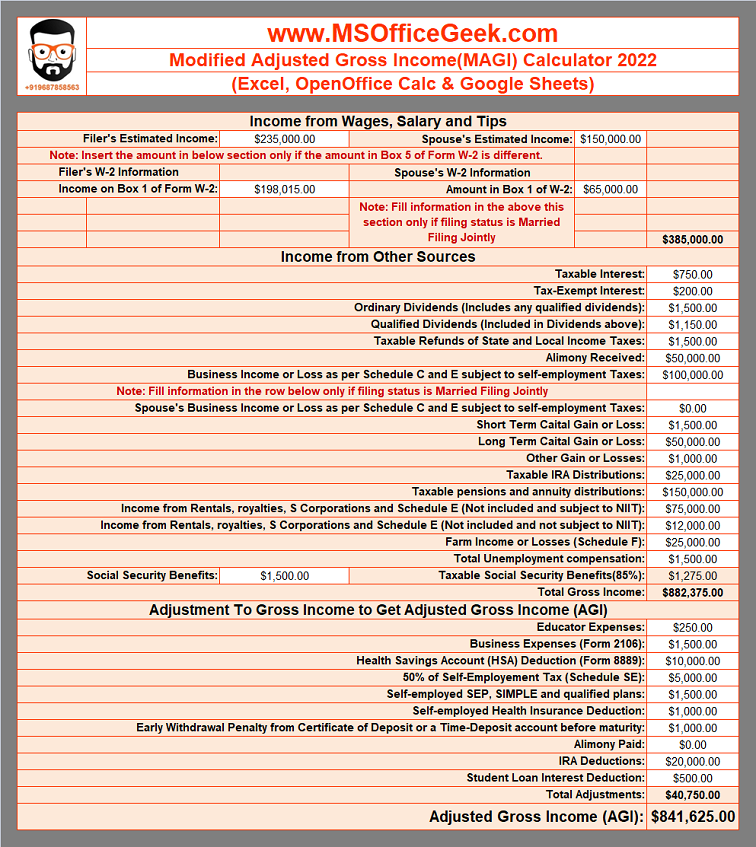

AGI Calculator 2024

This section consists of 3 subsections.

Income From Salaries, Wages, Tips, etc.

Add up all of your wages, salaries, tips, etc. Insert only the amount for the principal taxpayer in this section. In case you are filing jointly with your spouse then insert their amount on the right side. It should also include any tips that you haven’t disclosed to your employer, such as assigned tips that are shown in box 8 of your W-2 form(s).

In case, if your amount in Line 5 of Form W-2 is different then use the next section. While calculating the template will use the amount whichever is higher. If you’re unclear about the amount or don’t have access to your W-2 form, enter $0 here.

Income From Other Sources

Moreover, insert income from other sources. Enter only those amounts that apply to you.

Note: Fill information in the Spouse’s Business Income only if the filing status is Married Filing Jointly.

85% of the total Social Security Benefits are taxable. Thus, insert the full amount in the cell and it will automatically calculate the 85% amount in the next cell.

Adjustment to Gross Income

IRS allows some deductions in the form of adjustments to lower your taxable income. The amount left after these adjustments is called Adjusted Gross Income (AGI). If you are filing jointly kindly insert the sum of both your and your spouse’s amounts.

Moreover, you can deduct up to $250 in expenditures if you were a “qualified educator” in 2022. If you are married and both of you are ‘eligible educators,’ the cap is $500 ($250 each) if you file jointly.

Furthermore, from kindergarten through 12th grade teachers, instructors, counselors, administrators, or assistants who have worked at least 900 hours in a school during the school year are eligible.

Additionally, you can find taxable interest either on Form 1099-INT or Form 1099-OID. Dividends can be found on Form 1099-DIV.

In this section, insert only those amounts that apply to you.

Difference Between Modified Adjusted Gross Income (MAGI)and

Adjusted Gross Income (AGI)

In most cases, your MAGI and AGI are similar in value. On the other hand, these tiny modifications that convert your AGI to your MAGI might have a significant impact on your final tax return.

Your adjusted gross income is the total amount of money you earn minus certain deductions. The permissible income deductions are listed on the front page of your Form 1040.

Whereas, certain deductions are brought back in while computing MAGI. Because many of these deductions are uncommon, your AGI and MAGI may be the same.

The quantity of your AGI has an impact on how many tax credits and exemptions you may claim. If your AGI exceeds specific thresholds, many deductions will phase out or vanish entirely.

On the other hand, your MAGI is used to determine if you are eligible for certain tax deductions. One of the most important considerations is whether or not your contributions to an individual retirement plan are tax-deductible.

Thus, MAGI has an impact on our tax liabilities since certain tax credits and deductions are only accessible to people with a low or permissible MAGI.

Frequently Asked Questions

Source: www.IRS.gov

If you like this article, please share it on different social media platforms so that your friends and colleagues can also benefit from it. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.

Disclaimer: This article is for information and educational purposes. Information provided here shall not be treated as tax advice. Kindly consult a tax expert before filing your tax return.

Pingback: Ready-To-Use Adjusted Gross Income Calculator 2022 - MSOfficeGeek

Pingback: Ready-To-Use Section 179 Deduction Calculator 2022 - MSOfficeGeek

Pingback: How To Fill Schedule B of Form 1040? - MSOfficeGeek