UAE VAT Payable Calculator Template in Excel, OpenOffice Calc, Google Sheet, & PDF to calculate VAT liability under the Federal VAT Law 2017.

Just insert the taxable value from the sales and purchase Register along with imports and it will automatically calculate the VAT payable to FTA.

Moreover, you can keep a record of all twelve months of a financial year starting from January to December for annual VAT adjustments.

Table of Contents

Rules for Calculation of Payable UAE VAT

FTA has specified some rules for calculations of payable UAE VAT in Federal Decree-Law No 8 of 2017. These rules and regulations are given below for ready reference.

Article (53) – Calculation of Payable Tax

The Payable Tax for any Tax Period shall be calculated as being equal to the total Output Tax payable according to this Decree-Law and which has been done in the Tax Period less the total Recoverable Tax by said Taxable Person over the same Tax Period.

Article (54) – Recoverable Input Tax

1. The Input Tax is recoverable by a Taxable Person for any Tax Period. It is the total of Input Tax paid for Goods and Services for the following purposes:

a. Taxable Supplies.

b. Supplies that are made outside the State which would have been Taxable Supplies had they been made in the State.

c. Supplies specified in the Executive Regulation of this Decree-Law that are made outside the State, which would have been treated as exempt had they been made inside the State.

2. Where Goods are imported by a Taxable Person through another Implementing State and the intended final destination of those Goods was the State at the time of Import, then the Taxable Person shall be entitled to treat the Tax paid in respect of Import of Goods into the Implementing State as Recoverable Tax subject to conditions specified the Executive Regulation of this DecreeLaw.

3. Where Goods were acquired by a Taxable Person in another Implementing State and then moved into the State, the Taxable Person shall be entitled to treat the Tax paid in respect of the Goods in the Implementing State as recoverable Tax subject to the conditions specified in the Executive Regulation of this Decree-Law.

4. A Taxable Person shall not be entitled to recover any Input Tax in respect of Tax paid per Clause (2) of Article (48) of this Decree-Law.

5. The Executive Regulation of this Decree-Law shall specify the instances where Input Tax is excepted from being recovered.

Article (55) – Recovery of Recoverable Input Tax in the Tax Period

1. Taking into consideration the provisions of Article (56) of this Decree-Law, the Recoverable Input Tax may be deducted through the Tax Return relating to the first Tax Period in which the following conditions have been satisfied:

a. The Taxable Person receives and keeps the Tax Invoice as per the provisions of this Decree-Law, provided that the Tax Invoice includes the details of the supply related to such Input Tax, or keeps any other document according to Clause (3) of Article (65) of this Decree-Law about the Supply or Import on which Input Tax was paid.

b. The Taxable Person pays the Consideration for the Supply or any part thereof, as specified in the Executive Regulation of this Decree-Law.

2. If the Taxable Person entitled to recover the Input Tax fails to do so during the Tax Period in which the conditions stated in Clause (1) of this Article have been satisfied, he may include the Recoverable Tax in the Tax Return for the subsequent Tax Period.

Source: www.mof.gov.ae

Formula to Calculate Payable UAE VAT

Based on the above rules and regulations, the formula to calculate the VAT liability is as follows:

Output VAT – Input VAT – Recoverable Input Tax from Imports = Payable VAT

Where,

Output VAT = Sales – Sales Return + Debit Notes

Input Tax = Purchase – Purchase Return – Credit Notes

Recoverable Input Tax from Imports = VAT paid on goods or services Imported for business purposes.

Download UAE VAT Payable Calculator Template (Excel, OpenOffice Calc, Google Sheet, & PDF)

We have created a UAE VAT Payable Calculator with predefined formulas and functions. This template helps you to calculate the VAT liability for each month.

Download by clicking below on the desired format:

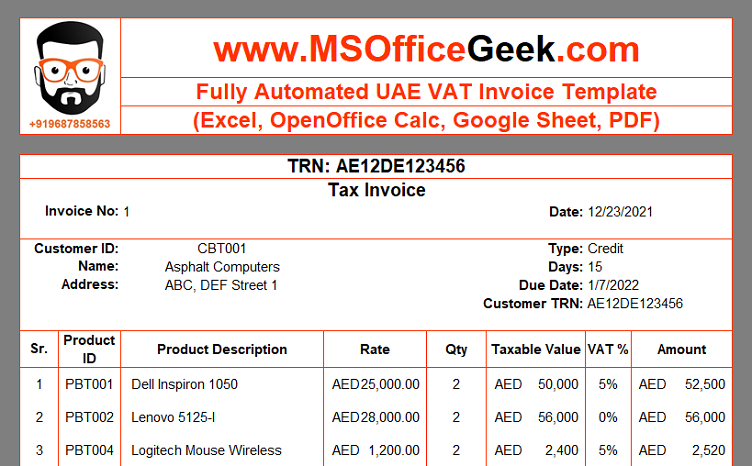

For regular UAE businesses, you can download the Fully Automated UAE VAT Invoice Template from the link below:

Fully Automated UAE VAT Invoice Template

Additionally, you can download other useful templates like UAE VAT Compliant Inventory, Accounts Payable Template, Cash Book Template, Petty Cash Book Template, Marketing Budget, Expense Report Template, and Payroll Template With Attendance.

Feel free to contact us for the customization of this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

Components of UAE VAT Payable Calculator Template

This template consists of 3 sheets: Monthly UAE VAT Payable Calculator, Yearly UAE VAT Calculation Sheet, and Printable UAE VAT Payable Calculator.

Let us understand how to use these sheets in detail.

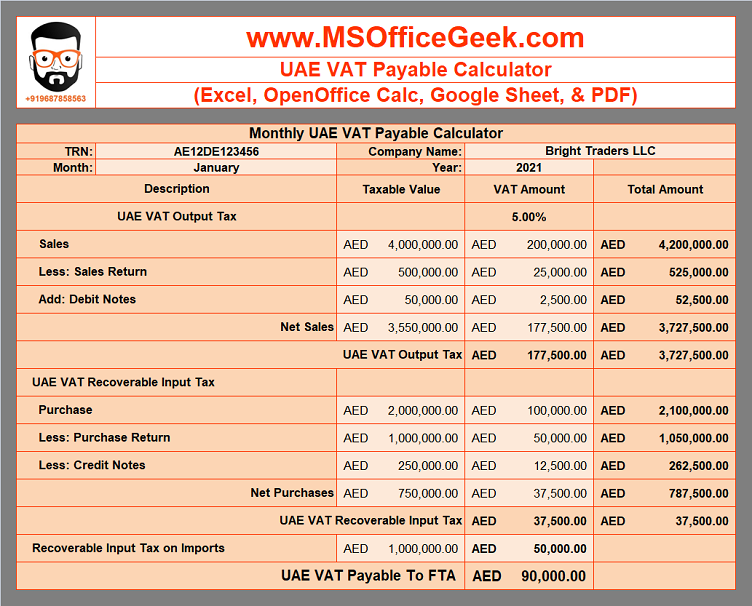

Monthly UAE VAT Payable Calculator

The monthly UAE VAT payable Calculator consists of 4 sections: Header Section, UAE VAT Output Calculations, UAE VAT Input Calculations, and UAE VAT Payable Calculations.

Header Section

The header section consists of the following:

TRN

Company Name

Month

Year

Enter your company name and TRN manually. Select month and year from the dropdown list.

Moreover, this section consists of the following columns to enter sales and purchase data:

Taxable Value

VAT Amount

Total Amount

UAE VAT Output Tax Calculations

This section consists of the following heads:

Sales

Sales Return

Debit Notes

Net Sales

Insert the amount of each against the respective heads. It auto-populates the VAT column. Moreover, the template automatically calculates the Net Sales for you. It applies the following formula:

Net Sales = Sales – Sales Returns + Debit Notes

UAE VAT Input Tax Calculations

This section consists of the following heads:

Purchase

Purchase Return

Crebit Notes

Net Purchase

Article 54 of Federal Decree-Law entitles all registered businesses to get an Input Tax Credit for goods or services purchased for business purposes.

Insert the amount of each against the respective heads. The template automatically calculates the Net Purchase for you. It applies the following formula:

Net Purchase = Sales – Purchase Returns – Credit Notes

UAE VAT Payable Calculations

Furthermore, Article (48) of Federal Decree-Law about Reverse Charge allows the taxpayers to take input tax for goods imported for business purposes. Moreover, it can be adjusted against the output tax liability.

Taxpayers can take input tax of VAT paid on Imports for goods purchased for business purposes under Reverse Charge Mechanism. Insert total imports value and the template calculates the 5% VAT Amount.

Moreover, this section displays the Net UAE VAT Payable. It applies the following formula to calculate the Net Payable VAT:

Net Payable = Total Output Tax – Total Recoverable Input Tax + Total Recoverable Input Tax from Imports

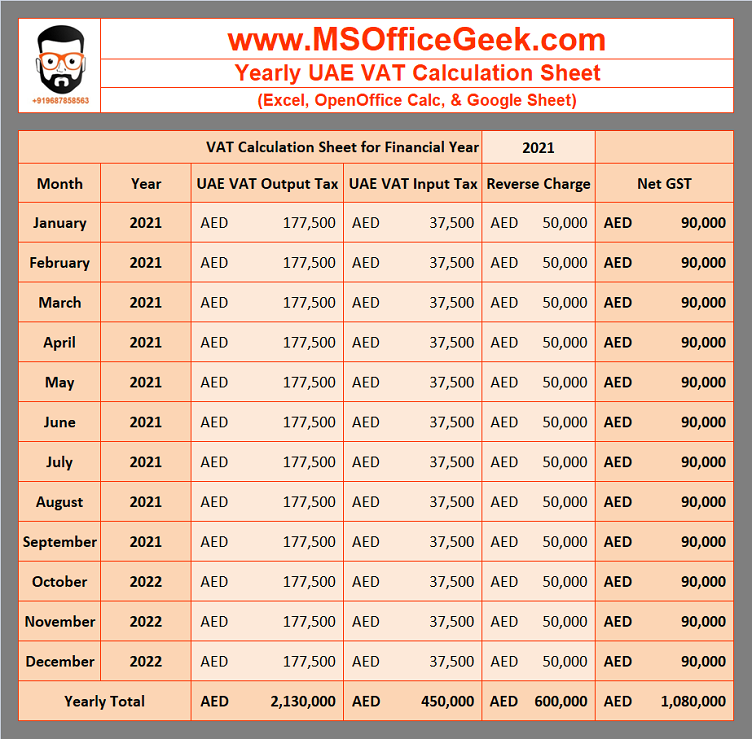

Yearly UAE VAT Calculation Sheet

This sheet consists of the monthly data of Output Tax, Input Tax, Input Tax from Reverse Charge, and Net Payable UAE VAT. At the end of each month, insert the respective figures against each month.

It is mandatory to maintain a monthly record of VAT liability as well as for adjustments at the end of the financial year.

Printable UE VAT Payable Calculator

This sheet is for Tax Agents and accountants who file UAE VAT returns for multiple businesses. Take a print of the following and insert the respective data. Punch in the data in the file to get the UAE VAT Payable Amount for each client.

Click the image to enlarge the file or click the button below to download the PDF:

Payment of UAE VAT Liability

As per the VAT law, the Taxpayers must make VAT payments through the Federal Tax Authority’s (FTA) online site. You can make payment of VAT to the UAE government by any E-dirham, Visa, or Master Card.

To process the payment follow the below-given steps:

- Go to FTA website (eservices.tax.gov.ae)

- Log in using your username and password.

- Click on ‘My Payments’ on the dashboard.

- Under ‘VAT & Penalty Payment’, it displays “Total Outstanding Liability”.

- Insert the amount and click the ‘Make Payment’ option.

FTA portal allows making partial payments of the VAT liability. But it is necessary to make full payment before the due date to avoid penalties.

Penalties for Non-Payment of VAT Liability

Failure to pay VAT results in the penalties listed below, which vary depending on the circumstances.

- Once payment of payable tax is late, 2% of the unpaid tax is levied immediately.

- 4% is applicable on the seventh day after the deadline for payment.

- A 1% daily penalty applies to any sum that remains unpaid for one calendar month after the payment deadline, with a maximum penalty of 300 percent.

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.