Ready-To-Use GST Compliant Inventory Template in Excel, OpenOffice Calc, and Google Sheets to manage inward and outward stock of goods.

Moreover, this template consists of a Master Inventory sheet along with an Inward Inventory Register and Outward Inventory Register for each month.

Furthermore, you can define reorder quantities for each product. The template highlights reorder products as well as out-of-stock products in different colors.

Table of Contents

GST Regulations for Managing Inventory/Stock under GST ACT

Section 35 of the Central Goods and Services Tax (CGST) Act, 2017 provides guidelines about Maintaining Accounts and Other Records.

Section 35 of CGST Act 2017 – Accounts and Records

According to Point (1) of Section 35 CGSR Act 2017:

Every registered person shall keep and maintain, at his principal place of business, as mentioned in the certificate of registration, a true and correct account of:

- Production or manufacture of goods.

- Inward and outward supply of goods or services or both.

- The stock of goods.

- Input tax credit availed.

- Output tax payable and paid.

- Such other particulars as may be prescribed.

Source: www.cbic.gov.in

Reverse Charge Mechanism – Purchase from Non-Registered Supplier

If a registered person acquires goods or services from an unregistered dealer (URD), the registered taxpayer is required to pay GST on a reverse charge basis (only for specific products/services and registered individuals), according to Section 9(4) of the CGST Act.

Moreover, all of the Act’s requirements will apply to such a receiver as if he were the person who was responsible for paying the tax on the delivery of goods or services.

Billing Under Reverse Charge Mechanism

The person delivering the products must indicate on the tax invoice whether tax is payable under the RCM, according to GST rules.

While making GST payments under RCM, keep the following considerations in mind:

Only if the goods or services are utilized for business or advancement of business may the beneficiary of the goods or services claim an ITC on the tax amount paid under RCM.

While discharging duty under RCM, a composition dealer shall pay tax at the usual rates, not the composition rates. They are also ineligible for any input tax credit for taxes paid.

The GST compensation cess can be applied to the RCM tax that is due or paid.

Input Tax Credit on Reverse Charge Mechanism

A supplier cannot claim an ITC for GST paid under the RCM. Only if the goods or services are used or will be utilized for business purposes can the receiver claim ITC on the GST amount paid under RCM on receipt of goods or services.

The receiver cannot use the ITC to pay output GST on products or services that are subject to a reverse charge; instead, the recipient must pay in cash.

Download GST Compliant Inventory Template (Excel, OpenOffice Calc & Google Sheet)

Keeping in mind the rules mentioned above, we have created a GST Compliant Inventory Template with predefined formulas and functions. This template helps maintain records of inward and outward movement of stock.

Download by clicking below on the desired format:

For regular GST businesses, you can download the Fully Automated GST Invoice Template from the link below:

Additionally, you can download Accounting templates like Inventory Template, Accounts Payable Template, Cash Book Template, Petty Cash Book Template, Marketing Budget, Expense Report Template, and Payroll Template With Attendance.

Furthermore, feel free to contact us for the customization of this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

How to use GST Compliant Inventory Template?

Four easy steps to manage your Inventory under GST Law:

- Go to Inward Register and Outward Register to maintain records of inward and outward movement of goods for each month.

- Using the “Filter Option”, select product and insert inward and outward quantities in the Master Inventory Template.

- Define reordering quantities and it will highlight the row of the reorder products in green color.

- When the product is out-of-stock, it will highlight the row in yellow color with a strike-through line.

Components of GST Compliant Inventory Template

This template consists of 3 sheets: Master Inventory Template, GST inventory Inward Register, and GST Inventory Outward Register.

Let us understand the contents of each sheet in detail.

GST Inventory Inward Register (Purchase Register)

Select Month and Year from the dropdown list. The template displays “Total Purchase During the Month” automatically based on your entry.

GST inventory Inward Register consists of the following columns:

Date

Product ID

Product

Purchase Invoice

Purchase Quantity

Vendor Name

Vendor GSTIN

Price

Taxable Value

GST %

GST Amount

Reverse Charge

Amount

Insert Date, Product ID, Product Name, Purchase Invoice Number, Purchase Quantity, Vendor name, GSTIN, and Price. The Taxable Value column auto-fills based on the price and quantity.

Insert applicable GST percentage to your commodity and it will calculate the GST amount. If the GSTIN column is blank then the template calculates RCM on such purchases. The Total Amount is auto-populated.

At the end of the month/week/day, update the data from this sheet to Master Inventory. You can select a perpetual product using the filter option to get the total inward quantity of the product.

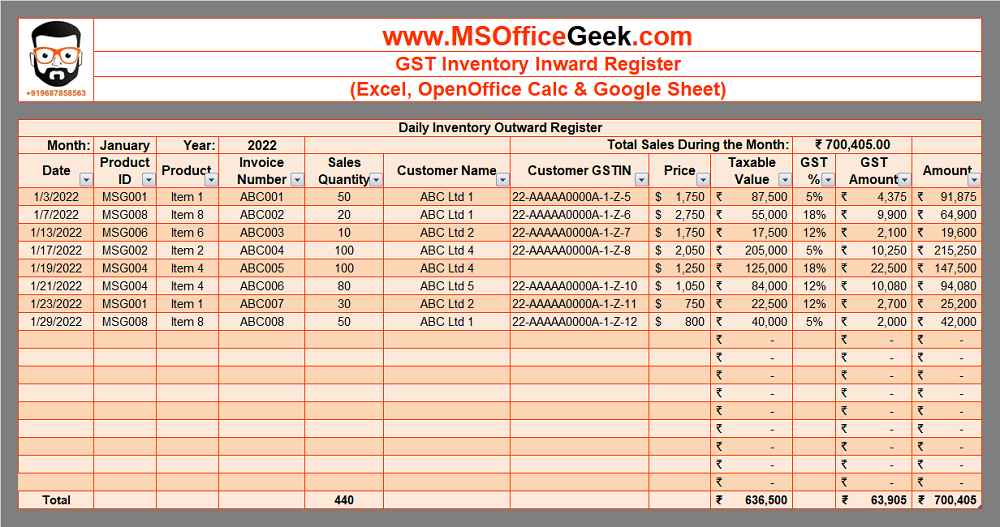

GST Inventory Outward Register (Sales Register)

Select Month and Year from the dropdown list. The template displays “Total Sales During the Month” automatically based on your entry.

GST inventory Inward Register consists of the following columns:

Date

Product ID

Product

Invoice Number

Sales Quantity

Customer Name

Customer GSTIN

Price

Taxable Value

GST %

GST Amount

Amount

Insert Sales Date, Product ID, Product Name, Invoice Number, Sales Quantity, Customer name, GSTIN, and Price. The Taxable Value column auto-fills based on the price and quantity.

Insert applicable GST percentage to your commodity and it will calculate the GST amount. The Total Amount is auto-populated.

At the end of the month/week/day, update the data from this sheet to Master Inventory. You can select a perpetual product using the filter option to get the total outward quantity of the product.

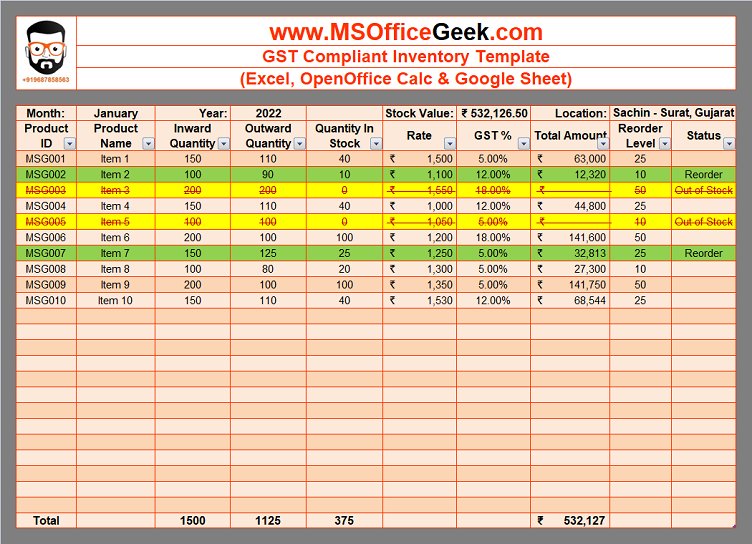

Master Inventory Template

Select Month and Year from the dropdown list. Insert Location of the warehouse. The template displays “Stock Value” automatically.

Master Inventory Template consists of the following columns:

Product ID

Product Name

Inward Quantity

Outward Quantity

Quantity In Stock

Product Rate

GST %

Total Amount

Reorder Level

Status

Insert the Product ID and Product Name. As discussed above, at the end of the month/week/day, you need to insert the inward and outward quantities. The “Quantity in Stock” column is auto-populated.

Insert purchase rate as the stock value is always calculated on the purchase price. Enter the applicable GST %. The “Total Amount” column sums up Taxable Value and GST Amount and displays the total invoice amount.

Moreover, you can select the reorder level. Reorder level helps to manage delays in delivery and to keep stock of well-performings products always available. Insert reorder quantity. Once the stock reaches this level the status column displays “Reorder” and automatically highlights the row in green color.

Furthermore, when the product is out-of-stock, the Status column displays “Out of Stock” and automatically the row turns yellow with a strike-through line.

Frequently Asked Questions

What is self invoicing?

Self-invoicing is to be done when purchased from an unregistered supplier, and such purchase of goods or services falls under reverse charge. This is because your supplier cannot issue a GST-compliant invoice to you, and thus you become liable to pay taxes on their behalf. Hence, self-invoicing, in this case, becomes necessary. Also, section 31(3)(g) states that a recipient who is liable to pay tax under section 9(3) or 9(4) shall issue a payment voucher at the time of making payment to the supplier.

On which expenses Reverse Charge Mechanism not applicable?

Salary, wages, Electricity, Interest, Car fuel Diesel/petrol), Government Fees (such as MCA fees, land registration fees, etc.)

Which Profit and Loss Statement items can attract GST under Reverse Charge Mechanism?

Rent, Commission payments, Printing and stationery, Repairs and Maintenance, Office Maintenance, Vehicle maintenance, Computer maintenance, Legal Fees, Consultancy Fees, Professional Fees, Audit Fees, Freight and transportation expenses (GTA), Gift expenses, Business promotion expenses, and Advertisement.

Source for FAQs: www.cbic-gst.gov.in, www.ClearTax.in

Click on the link above for more questions realted to Composition Scheme.

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.