Mileage Log Template in Excel, OpenOffice Calc & Google Sheets to track and record daily, monthly, and yearly miles traveled for business.

Moreover, you can use this mileage log as a supportive document for reimbursement as well as tax deduction purposes. Just record your mileage usage every month and the template automatically prepares a yearly report for you.

Furthermore, with the help of the Filter function, you can easily prepare customer-wise, location-wise, purpose-wise, and date-wise reports.

Table of Contents

What Is A Mileage Log?

A mileage log is an HR document that records the usage of a personal/company vehicle for business purposes. Employees need to record each trip along with the purpose of the visit.

Moreover, for employees who spend a substantial amount of time on the road for their profession a well-maintained mileage record is very important. These professions include salesmen and service workers. The same is the case for small business owners and self-employed professionals.

Not only that, this mileage record can turn into cash for you either in the form of reimbursement from the employer or through an IRS Business Mileage deduction policy.

You can simplify your work by using readymade mileage templates. The templates below are free, easy-to-use, and customizable for tracking mileage-related expenses like miles traveled and other transportation-related costs.

What Is Mileage Reimbursement?

Repayment of business-related travel by the employee in his/her vehicle refers to Mileage Reimbursement.

In simple terms, when an employee travels in his or her personal or corporate vehicle, he or she must record the mileage of each trip to get compensated for miles.

Depending on the company policy, the reimbursement can be either on fuel bills or predetermined mileage rates. Thus, in case your company has a mileage rate policy you need to manage a mileage log

Additionally, businesses can claim a tax deduction for the expenses at a predefined mileage rate by IRS. This deduction can be obtained either by Standard Mileage Deduction or Actual Mileage Deduction. A mileage log can be helpful when a business is planning to claim tax deductions on an actual mileage basis.

Download Yearly Mileage Log Template (Excel, OpenOffice Calc & Google Sheet)

We have created a Yearly Mileage Log Template with predefined formulas and functions to track and record mileage expenses for business purposes.

Download by clicking below on the desired format:

Additionally, you can also download other HR templates like Payroll Template With Attendance, Timesheet Template, Paycheck Calculator, Overtime Calculator, Simple Salary Sheet, Job Application Tracker, and Salary Certificate Template depending on the company requirement.

Components of Mileage Log Template

Mileage Log Template consists of a total of 15 sheets: 1 sheet for General Mileage Log, 12 monthly log sheets, 1 Annual Mileage Expense Report, and 1 Printable Mileage Log Format.

Mileage Log Template

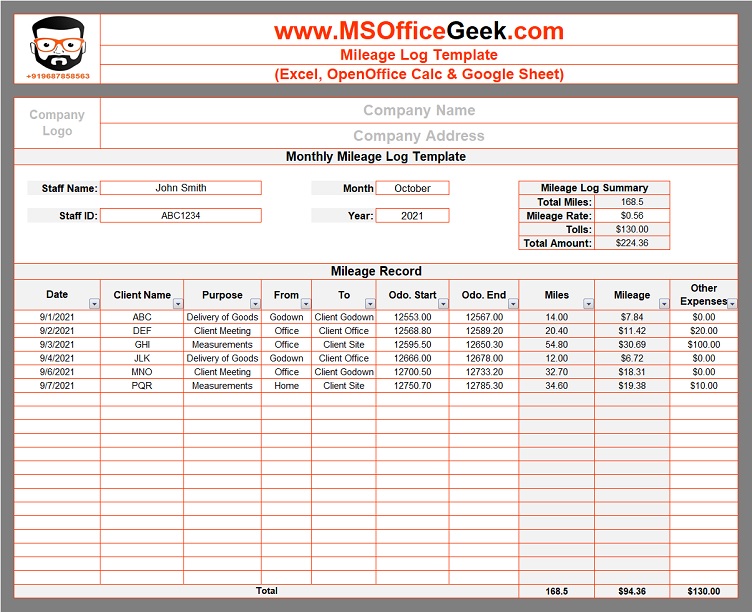

This template consists of 3 sections: Company details, Employee Details, and Mileage Record Section.

The company details section includes the company name, address, and logo. Whereas the employee details section consists of employee name, employee id, month, and year of mileage report.

The Mileage Record Section consists of the following columns:

Date

Client Name

Purpose

From

To

Odo. Start

Odo. End

Miles

Mileage

Other Expenses

Just follow these simple six-step to prepare your mileage log:

- Insert Company name, logo, and address.

- Enter employee id as well as employee name.

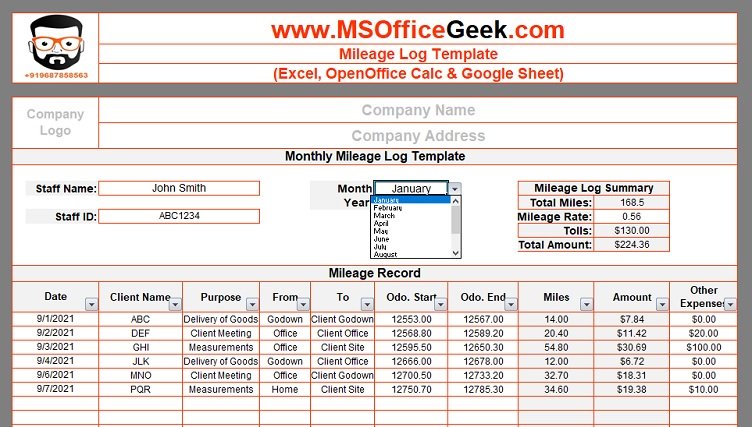

- Select month and year from the dropdown list.

- Punch in date, client name, purpose, to and from the location.

- Insert odometer reading at the start and the end.

- Miles and Mileage amount columns are auto-calculated.

- Insert other related expenses like tolls, wear and tear during the trip.

That’s it. Your mileage log is ready. Moreover, it displays a summary of the sheet at the top.

12 Monthly Mileage Log Sheet

These 12 sheets are the same as the above sheet. These sheets are for record purposes.

At the end of the month, copy the data from Mileage Log Template to the respective monthly sheet to keep a track record for each month.

Annual Mileage Expense Report

This sheet consists of a summary of mileage expenses made during the whole year.

It consists of the following columns:

Month

Miles

Mileage Exp

Other Expenses

Total

This sheet is auto-populated. Thus, you don’t need to make any entries in this sheet.

Printable Mileage Log Format

Click on the image to download and print the Printable Mileage Log Format:

Business Mileage Reimbursement Procedure

Most businesses employ a per-mile rate set by the IRS which accounts for all fixed and variable costs associated with operating a vehicle. This is commonly referred to as the standard mileage rate. Currently, the IRS Mileage Rate is 56 cents per mile.

However, you are not required to utilize the regular mileage rate. Instead, you can use the Fixed and Variable Rate Allowance (FAVR) that provides a base monthly allowance. The FAVR is enhanced by variable payments based on real prices of fuel and other expenses in the local region.

The reimbursement procedure mandates the employees to provide proper documents to support the expenses to be approved by the employer.

Regardless of whether you choose the regular mileage reimbursement rate or FAVR, it’s necessary to describe it in your company policy so that employees are aware of it. While using the standard mileage rate, make sure employees know that it covers all costs and not just the cost of fuel.

Moreover, in case the business neither uses the standard rate nor the FAVR, then this should be specified in the company’s reimbursement policy.

For an employer, it is necessary to properly understand the obligations under both federal and state laws. They should establish a mileage rate that fairly reimburses employees without increasing their compensation. An increase in compensation can lead to increased payroll and income taxes for both.

Tax Applicability of Mileage Reimbursement

Both employers and independent contractors can deduct mileage reimbursement from their taxes. For employees, it is not income and hence it is also non-taxable up to a certain limit.

However, if an employer provides reimbursement to employees for driving for work-related activities more than the genuine cost of the trip, a portion of the reimbursement is considered as remuneration and liable to taxes.

Therefore, many businesses prefer to give mileage reimbursement at flat rates to comply with applicable government regulations.

However, in case the flat rates are high then it can result in income tax to the employee as well as payroll taxes to the employer.

Mileage Tracking Apps

Here are some Mileage Tracking Apps that can be helpful to you:

MileIQ

MileIQ is a free mileage tracking app that uses GPS-backed drive-detection technology to automatically log and track miles and calculate the value of your drives for taxes or reimbursements.

To know more in detail about the features of MileIQ click on the link below:

MileWiz 2020

The MileWiz driving log uses your smartphone’s GPS to record your mileage as you drive. You can categorize trips the way you want or have the app do it for you.

To know more in detail about the features of MileWiz click on the link below:

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.