IRS Compliant Mileage Log Template in Excel, OpenOffice Calc & Google Sheets to record and claim IRS tax deductions of mileage expenses.

With the help of this template, you can manage monthly records of mileage as well as prepare a yearly report of total mileage expenses during the year for IRS tax deductions.

Moreover, it also consists of a blank printable IRS Compliant Mileage Log to carry wherever you go. Just insert the details in the spreadsheet and it will calculate the rest for you.

Table of Contents

What is an IRS Compliant Mileage Log?

A mileage log is a document that records miles driven for business, medical, charity, or relocation purposes over a specific time to claim a tax deduction.

To obtain a deduction for mileage on your tax return, it is mandatory to keep track of the mileage regularly which can be submitted to IRS with tax forms or as demanded.

Why Should We Maintain A Mileage Log?

According to the tax deduction rules of the IRS for mileage, it is mandatory to keep detailed records of your driving to deduct mileage on your tax return. The records must display both miles driven for professional and personal travel.

You must correctly document your deductible miles to present the IRS with adequate proof of entitled deductions and to avoid a tax audit.

What Does a Mileage Log Contain?

A Mileage Log consists of detailed information about the trip. It consists of the date of travel, purpose, starting and ending points of the trip, odometer record of start and end, and total expenses.

The mileage log must bifurcate business travel based on purpose. In simple terms, it must display business, medical, moving, and charity mileage separately.

Download IRS Compliant Mileage Log Template 2022 (Excel, OpenOffice Calc & Google Sheets)

We have created an IRS Compliant Mileage Log Template with predefined formulas and functions to track and record mileage expenses for tax deduction purposes.

Download by clicking below on the desired format:

Additionally, you can also download other HR templates like Payroll Template With Attendance, Timesheet Template, Paycheck Calculator, Overtime Calculator, Simple Salary Sheet, Job Application Tracker, and Salary Certificate Template depending on the company’s requirements.

Components of IRS-Compliant Mileage Log Template

The Mileage Log Template consists of a total of 15 sheets: 1 sheet for the Mileage Log, 12 monthly log sheets, 1 Annual Mileage Expense Report, and 1 Printable IRS Compliant Mileage Log Format.

IRS Compliant Mileage Log 2022

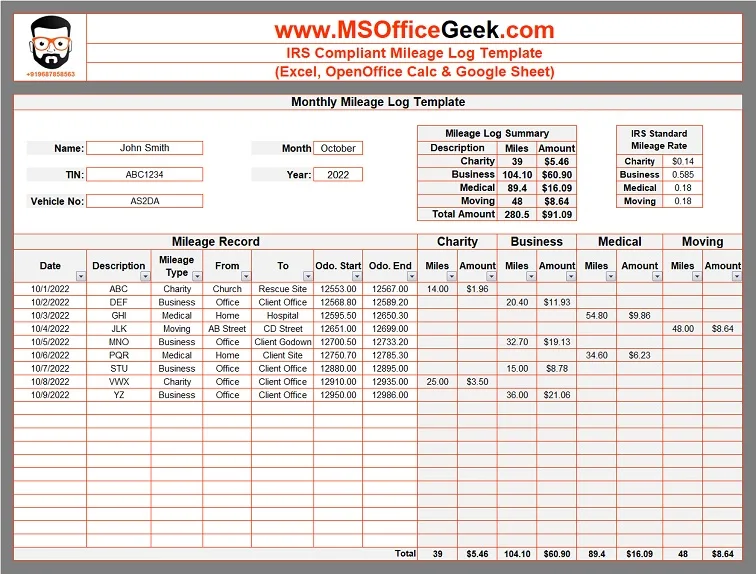

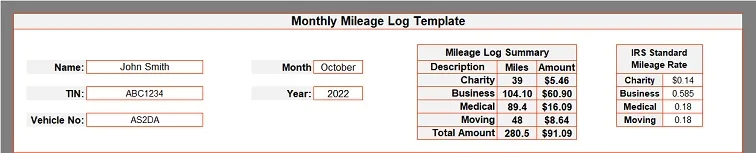

This template consists of 2 sections: Personal information, and the Mileage Record Section.

Personal Information Section

The personal information section consists of the following:

Name

Tax Identification Number (TIN)

Vehicle Number

Month

Year

IRS Approved Mileage Rates

Mileage Log Summary

Insert your name, TIN, and vehicle registration number. Select the month and year from the dropdown list. IRS Standard Mileage Rates are preapproved rates for each tax period. You can get them from the IRS website.

This section also displays a purpose-wise summary of mileage expenses done during the month.

Mileage Record Section

This section consists of the following columns:

Date

Description

Mileage Type

From

To

Odometer Start

Odometer End

Miles Travelled

Amount

Insert date the date of travel on which the trip takes place. In the description column, insert the name of the organization, hospital, church, etc. Select the mileage type from the dropdown list. It can be one of the following: Business, Charity, Moving, or Medical.

Insert the start and end destination of your trip. This can be a city, area, street, or country. Record the odometer reading at the time of starting the trip as well as at the end of the trip.

The Miles Travelled column automatically calculates the miles by subtracting the odometer readings. It also automatically bifurcates the miles based on the type of travel.

It displays charity, business, moving, and medical miles based on selected input in the mileage type column using IF Function. Lastly, it displays the column total for each section.

Monthly Mileage Record Sheet

There are 12 different monthly sheets from January to December. This section is for record purposes. Hence, at the end of every month just copy the data and paste it into the respective month.

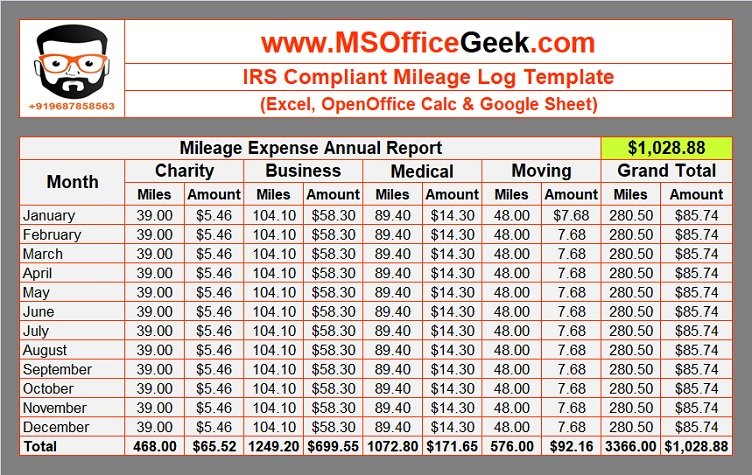

Annual Mileage Expense Report

This sheet displays the total miles run monthly and annually. This sheet consists of link references. Therefore, you don’t need to insert anything data in this sheet.

Printable IRS Compliant Mileage Log Printable Format

Click on the image to download and print the Printable IRS Compliant Mileage Log Format:

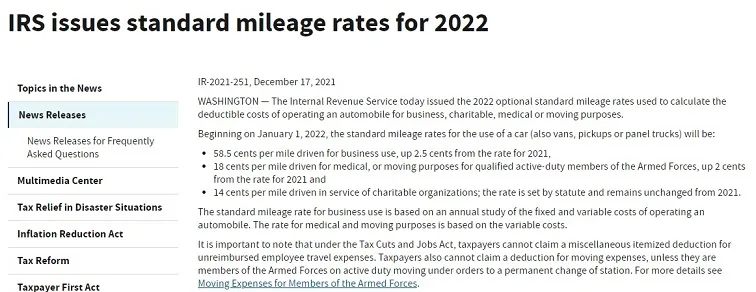

IRS Standard Mileage Rates 2022

Source: www.irs.gov

IRS Rules for Standard Mileage Rate Deduction

- If you use the standard mileage rate for a year, you can’t deduct your actual car expenses for that year.

- Moreover, if you want to use the standard mileage rate for a car you own, you must choose to use it in the first year the car is available for use in your business.

- If you want to use the standard mileage rate for a car you lease, you must use it for the entire lease period.

- You should keep the proof you need in an account book, diary, log, statement of expense, trip sheet, or similar record. You should also keep documentary evidence that, together with your record, will support each element of an expense.

- It is mandatory to have documentary evidence, such as receipts, canceled checks, or bills, to support your expenses.

- Documentary evidence ordinarily will be considered adequate if it shows the amount, date, place, and essential character of the expense.

Source: www.irs.gov

Standard Mileage Rate Limitations

You cannot use the standard mileage rate if you:

- Use five or more cars at the same time. See Actual Car Expenses, later, for information on how to figure your deduction.

- If you have claimed a depreciation deduction for the car using any method other than a straight line, for example, MACRS.

- If already Claimed a section 179 deduction.

- Claimed the special depreciation allowance on the car; or

- Claimed actual car expenses after 1997 for a car you leased.

For detailed information on deductible business expenses please read the IRS Publication:

Publication 463 – Travel, Gift, and Car Expenses

Frequently Asked Questions

Does the IRS ask for odometer readings for Mileage Log?

There isn't any specification about this in the IRS publication. But yet the formats provided by the IRS have columns for recording odometer reading at the start and end of the trip. Hence, it is better to keep a record of the odometer reading but not mandatory.

How long the is it necessary to keep records and receipts?

According to IRS Publication 463, you must keep records and receipts for at least 3 years from the date you file the income tax return on which the deduction is claimed.

What is Fixed and Variable Rate (FAVR)?

FAVR is an allowance method that businesses use to reimburse car expenses. Under this method, the employer pays the employee an allowance that includes fixed and variable costs associated with business travel. Usually, the cents-per-mile rate is used to cover variable operating costs like gas, oil, etc. Whereas, a fixed amount is used to cover your fixed costs like depreciation, insurance, etc. Under this method, the employee has to maintain records.

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.

Pingback: Ready-To-Use Traditional IRA Calculator 2022 - MSOfficeGeek

Pingback: Employee Expense Reimbursement Form Template - MSOfficeGeek