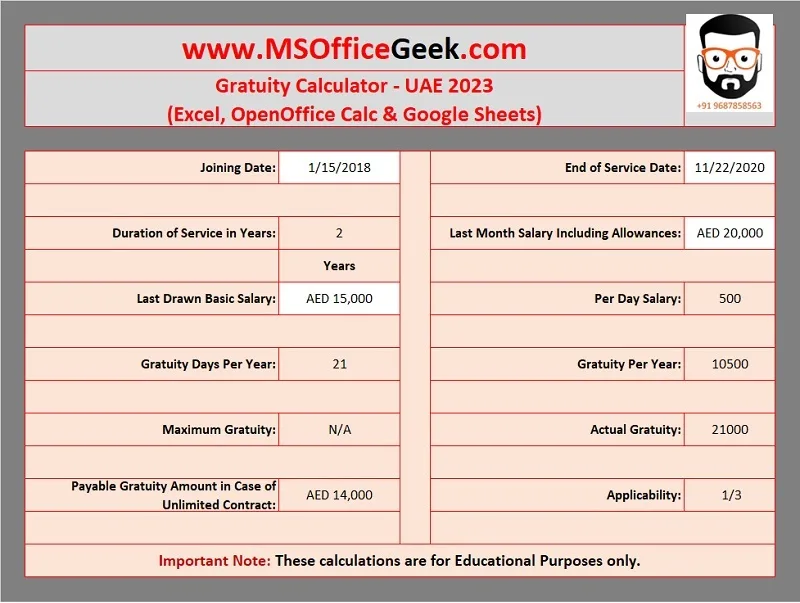

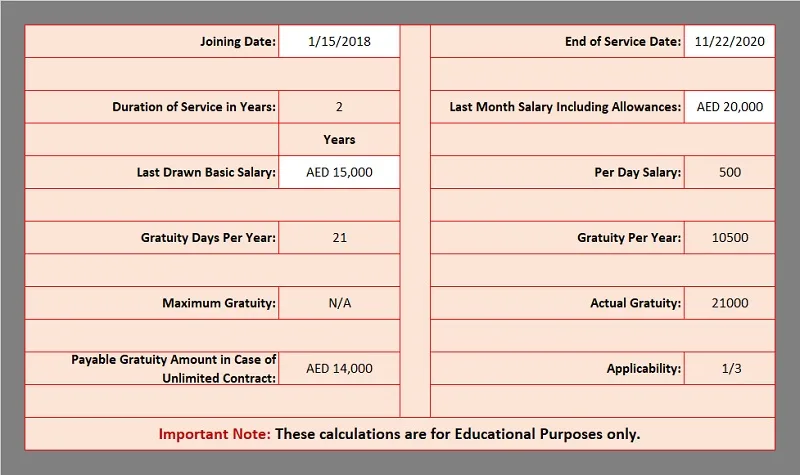

Download the UAE Gratuity Calculator Template in Microsoft Excel, OpenOffice Calc, and Google Sheets to easily calculate your gratuity amount as the end-of-service benefits.

Just insert your joining date and your last working date along with your basic salary and the template will automatically calculate your tenure, and gratuity amount based on UAE labor law.

This template can be helpful to you whether you are an employee seeking clarity on your end-of-service benefits or an employer striving to adhere to the country’s labor laws.

Table of Contents

Download UAE Gratuity Calculator Template (Microsoft Excel, OpenOffice Calc & Google Sheets)

We have created a ready-to-use Employee Leave Tracker Template with predefined formulas that can help you easily calculate your or your employee’s gratuity.

Additionally, you can also download other templates like Employee Shift Rotation Schedule, Payroll Template With Attendance, Timesheet Template, Paycheck Calculator, Employee Training Log, Job Application Tracker, Business Mileage Log Template, and IRS Compliant Mileage Log Template depending on the company’s requirements.

Moreover, you can also download Accounting Templates, HR Templates, and Educational Templates which can be helpful to you.

In case, you want to customize any of the above templates feel free to contact us. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

How To Use UAE Gratuity Calculator?

Calculate your gratuity using this UAE Gratuity Calculator in just 3 easy steps:

- Insert your “Joining Date”.

- Insert your “End-Of-Service Date”.

- Enter your “Last Drawn Monthly Salary including Allowances”.

- Enter your “Last Drawn Basic Salary”.

Insert data in the white spaces only as other heads consist of formulas. Let us understand the workings of the UAE Gratuity Calculator template in detail.

Joining Date

Insert the joining date. This date will be the original joining date even if you joined at a junior level and then climbed the designations.

For example, you joined as a Junior Account Officer in 2011. Then during the service years, you were promoted to Senior Accounts Officer position in 2013 and then to Accounts Head in 2015 in the same company. Based on the example, your date of joining will be 01/01/2011.

Last Day of the Service or End of Service Date

Insert the date of end-of-service. This will be the last working of your service. If the gratuity is calculated before leaving the company, then the last working day will be your last day at the office.

It is necessary to be vigilant in entering this date. For example, your last day of working is the last day of your visa which is completing 5 years. But, the person calculating or you insert a different date then the years completed will be 4. This will affect the gratuity calculations.

Duration of Service

Don’t insert anything in this field. This field is auto-calculated using the DATEDIF Function. This field calculates the total number of completed years in service. It is used to calculate your gratuity amount.

Last Full Salary Including Allowances

Insert your last drawn salary amount including the allowances and deductions.

Usually, the gratuity is calculated on the Basic Salary. This field is necessary to include here because of the rule that the gratuity amount should not exceed the full salary amount of 24 months.

Last Drawn Basic Salary

Insert the Basic Salary amount of your last drawn salary. You can get this amount from your Salary Slip.

Salary Per Day

This field calculates your per-day salary for gratuity calculation purposes. As per the rules, you are given 21 day’s salary if you haven’t completed 3 years and 30 day’s salary if you have completed 5 years. We will discuss the Gratuity Rules later in the article.

Gratuity Days Per Year

You don’t need to enter anything in this field. It consists of predefined formulas and automatically displays the days per year calculation based on Gratuity Rules.

Gratuity Per Year

Based on Gratuity rules and your tenure, this field calculates your per-year gratuity.

The formula used here is:

Number of Days Applicable Per Year X Last Drawn Salary

Maximum Gratuity

In case of service for more than 25 years, this field is applicable. Sometimes, the employer keeps a lower basic salary in contracts to save money on end-of-service benefits.

Thus, even if the total salary is high and basic are low then you cannot claim the gratuity higher than two years salary.

Actual Gratuity

This field calculates the actual gratuity for your service.

The formula used here is:

Number of Days Per Year X Last Drawn Basic Salary X Years of Service

Applicability

The gratuity rules are that if your tenure is between 1 and 3 years you are entitled to 1/3rd of the gratuity and if between 3 to 5 years then you are entitled to 2/3 of the gratuity amount.

Payable Gratuity Amount

Based on the applicability, this field calculates the Gratuity Amount.

That’s it. This is how you can easily calculate your Gratuity using this UAE Gratuity Calculator.

What Is Gratuity?

Gratuity, also known as end-of-service benefits or termination indemnity, is a fundamental aspect of employment in the United Arab Emirates (UAE). It is essentially a monetary reward provided to employees by their employers as a token of appreciation for their service and commitment over the course of their employment.

Gratuity is considered a form of financial security for employees, ensuring that they receive a lump sum payment upon meeting certain conditions outlined in UAE labor laws.

To be eligible for gratuity, an employee usually needs to have completed a minimum period of continuous service with their employer. The specifics of this period may vary depending on the UAE labor law and the terms of the employment contract.

Gratuity is typically payable in cases of both voluntary and involuntary termination of employment. This means that whether an employee resigns or is terminated by the employer, they may be entitled to gratuity, subject to the conditions mentioned in the labor law.

The amount of gratuity is calculated based on the employee’s length of service and their final basic salary at the time of termination. The formula used to calculate gratuity is often stipulated by UAE labor laws.

Eligibility Criteria for Gratuity In UAE

Under the UAE labor law, gratuity payments are not universally granted to all employees. Specific conditions must be met to qualify for gratuity benefits.

Here are the essential eligibility criteria to determine gratuity applicability.

Employment Contract

To be eligible for gratuity in the UAE, there must be a valid employment labor contract in place. This contract could be of two types: limited (fixed-term) or unlimited (open-ended), depending on the terms agreed upon between the employer and the employee.

Continuous Service

Employees must have rendered continuous service with the same employer for a minimum duration of one year or more. This means that the tenure of employment should not include any significant gaps or interruptions.

Unlimited Contract Resignation

For employees under an unlimited contract, gratuity benefits may not be applicable if they resign without completing the notice period as stipulated in the contract, fail to demonstrate the employer’s non-fulfillment of legal obligations, or cannot provide evidence of assault by the employer, or their representatives. This underscores the importance of adhering to contractual terms and conditions.

Gratuity Rules for Limited Contract

In a limited employment contract, both employees and employers commit to a specific duration of employment, often with a fixed end date. However, if an employee decides to resign before the agreed-upon period expires, they may face consequences such as a labor ban, forfeiture of labor rights, or even potential compensation owed to the employer.

Here are the rules governing gratuity calculations for employees in limited contracts:

- Less than 1 Year of Service: If an employee leaves their job before completing one year of service with the organization, they are not entitled to receive a gratuity amount.

- 1 to 5 Years of Service: Employees with a service duration ranging from 1 to 5 years are eligible for gratuity payment. The calculation is based on 21 days of salary for each year of work.

- 5 or More Years of Service: For employees who have dedicated 5 or more years of service, the gratuity calculation is slightly different. They receive 21 days of salary for the first 5 years of service and an additional 30 days of salary for each year beyond the initial 5 years

Example

To calculate the gratuity amount for an employee, you can follow this formula: Multiply the daily wage by either 21 or 30, depending on the duration of their service in the company. For example, if the daily wage is AED 500:

For 1 to 5 years of service: 500 * 21 = AED 10,500. This amount is received by the employee for each year of service within this range.

For 5 or more years of service: 500 * 21 (for the first 5 years) + 500 * 30 (for each additional year beyond 5 years).

It’s important to note that the total gratuity amount for employees working for 5 years or more should not exceed the equivalent of the total salary for two years. This provision ensures a reasonable and equitable gratuity payment structure, while also preventing excessive payouts.

Gratuity Rules for Limited Contract

In an unlimited employment contract in the United Arab Emirates (UAE), there is no fixed period of employment specified, and employees typically need to serve a notice period of 1 to 3 months before departing from the organization.

Here’s how the gratuity calculation works in an unlimited contract:

- Employees with less than one year of service with the organization do not qualify for any gratuity amount.

- Employees who have served between 1 to 3 years are eligible to receive one-third of their basic salary for each year of employment.

- Those employees whose service duration ranges from 3 to 5 years are entitled to receive two-thirds of their basic salary for each year worked within this range.

- Employees who have completed 5 or more years of service are entitled to 21 days’ worth of basic salary for the first 5 years of service and an additional 30 days’ worth of basic salary for each year served beyond the initial 5 years.

Specific Rules for Unlimited Contract

To calculate the gratuity amount for an employee in an unlimited contract, the formula involves multiplying one-third or two-thirds of the 21 days of salary (e.g., AED 10,500) based on the employee’s years of service.

- For employees with more than 5 years of service, the calculation includes 21 days of salary for the first five years. Whereas an additional 30 days of salary for each year served beyond the initial 5 years.

- While the formulas for gratuity calculation for unlimited and limited contracts are almost similar, there is a slight difference when the employee under an unlimited contract resigns. This rule entitles you only to 1/3rd or 2/3rd of the gratuity payouts depending on your service period.

Enjoy using this template and let us know if you want us to make any other template.

If you like this article, kindly share it on different social media platforms so that your friends and colleagues can also benefit from the same. Sharing is Caring.

Please send us your queries or suggestions in the comment section below. We will be more than happy to assist you.