Balance Sheet Template in Excel, OpenOffice Calc & Google Sheet to make informed business decisions based on comparative yearly analysis.

This template categorizes all types of Assets, Liabilities, and Equity based on the size of the business. Moreover, it consists of a Simple Balance Sheet for SMEs, a Monthly Balance Sheet, and a Corporate Balance sheet.

Moreover, each balance sheet template performs ratio analysis for the respective year. In addition to the above, you can analyze your Balance sheet with horizontal as well as vertical analysis.

Vertical Analysis or the common-size analysis helps to analyze the relative percentage change in the line items over a specific period. Whereas, the horizontal analysis or trend analysis helps to compare the changes in line items for 2 subsequent years of the Balance Sheet.

Table of Contents

What is a Balance Sheet?

A Balance Sheet is one of the 6 financial statements of the double-entry accounting system. Moreover, it is an important document in financial modeling while preparing the business plan.

It displays the net total assets of the company based on account balances the P & L Statement and the adjusted Trial Balance of the company. IT provides insights on how the assets are formed; through equity or debt.

In simple terms, a balance sheet is the statement of net worth or the financial position of any business. It offers a snapshot of what our business owns and owes. It displays the assets, liabilities, capital, debt, etc. of the company at the end of the accounting period.

Balance Sheet Equation

Assets – (Liabilities + Shareholder’s Equity)

In simple terms, the worth of the total assets of the company must be equal to the sum of liabilities and shareholder’s equity. If there is a difference in these both there are chances that either the amount reported is wrong or you might have missed something.

Structure of the Balance Sheet

Usually, every balance sheet consists of 3 sections: Assets, Liabilities, and Shareholder’s Equity. The line items may differ based on size and industry. However, we have listed below common items that are common in most balance sheets.

Assets

Assets are of 2 types: Current Assets and Non-Current Assets.

Current Assets mean those assets which are in cash form or are cash equivalent and can easily be converted to cash. Whereas non-current liabilities require time to encash and either are in the form of land, property, goodwill, etc.

Current Assets include:

Cash and Cash Equivalents

Investments – Short-term

Accounts Receivable

Other Receivables

Inventories

Prepaid Expenses

Miscellaneous

Non-Current Assets are further divided into two groups: Fixed/Tangible Assets and Intangible Assets.

Fixed/Tangible Assets include:

Long Term Investments

Land

Land Improvements

Building

Equipment

Accumulated Depreciation

Whereas the Intangible Assets include:

Goodwill

Licenses

Trademarks

Patents

Copyrights

Other Asset section includes the loans and receivables from employees. Total Asset is equal to the sum of current assets, fixed assets, and intangible assets.

Thus, Total Assets = Current Assets + Tangible Assets + Intangible Assets + Other Assets

Liabilities

Likewise, liabilities are also of two types: Current liabilities and Non-Current Liabilities. Current Liabilities are amounts that company owes and payments are to be paid in near future. Whereas, non-current liabilities are those whose payments are later.

Current Liabilities include:

Short-term loans payable

Current Portion – Long-Term Debt

Accounts payable

Accrued compensation and benefits

Other Accrued Expenses

Income tax payable

Deferred revenues

Non-Current or Long-Term Liabilities include:

Notes Payable

Bonds Payable

Deffered Income Tax

Total liabilities are equal to the sum of current liabilities and non-current liabilities.

Thus, Total Liabilities = Current Liabilities + Non-Current Liabilities

Shareholder’s Equity

Shareholder’s Equity includes:

Owner’s Capital or/and Shareholder’s Capital

Retained Earnings

Treasury Stock

Shareholder’s equity Shareholders equity is the capital invested by the owner or capital borrowed in the form of equity from the market. In simple terms, it is the money left with the company left after the payment of the debt owed to non-shareholders.

It also includes the retained earnings of the business. These are the net earnings a company either reinvests in the business or uses to pay off debt.

Treasury stock is the stock a company repurchases. These stocks are held and can be sold at a later date to raise cash in the future.

Importance of A Balance Sheet

A balance sheet is an important document as it provides insights into the liquidity, efficiency, and leverage of the business.

Liquidity

You can get a clear picture of the liquidity of your business by comparing current assets to current liabilities. It also depicts the readily available cash with the company.

Moreover, Assets must always be greater than liabilities. This provides a buffer to cover your short-term financial obligations.

In other words, if current liabilities are greater than current assets, then the business might fall short of cash to repay those obligations.

Efficiency

An increase in assets and revenue projects the efficiency of the management to use its assets. It shows how well the company uses its assets to generate revenue.

Leverage

With your balance sheet, you can see how much leverage your business has. Leverage means the ratio of debt and assets against your equity.

Leverage helps us to know if our company can fulfill its financial obligations like debts. A lower leverage ratio indicates that it is easier for the company to raise money from the market and financial institutions.

On the contrary, a higher leverage ratio indicates financial risk. Thus, investors, shareholders, financial institutions don’t prefer higher leverage ratios. Hence, the company is less likely to receive finance with favorable terms or even denied loans.

Given below are 5 ready-to-use Balance Sheet Templates that are free to download and use.

Download Balance Sheet Template (Excel, OpenOffice Calc & Google Sheet)

We have created 5 different Balance Sheet Templates with predefined formulas and functions to simplify the process of preparation and analysis of the Balance Sheets. Insert the data against the respective line item and the template will do the rest for you.

Download your desired format and start using it.

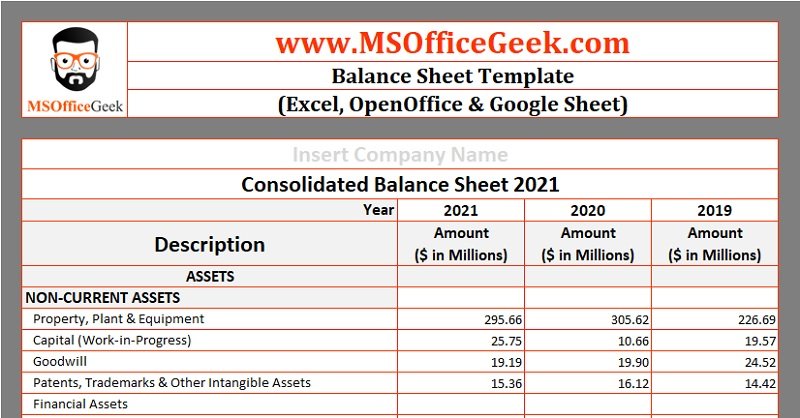

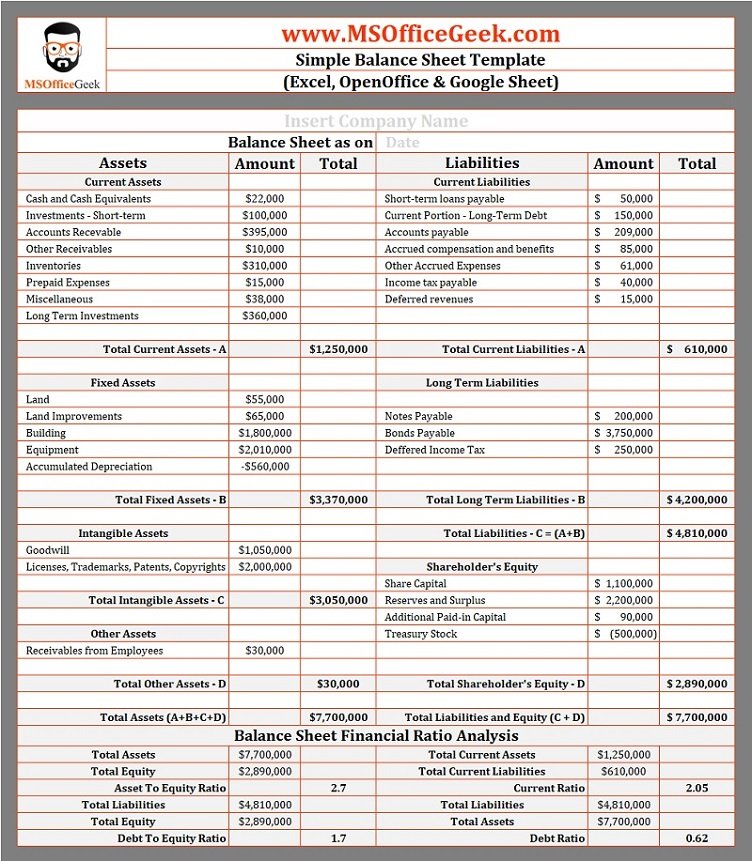

Simple Balance Sheet Template For SMEs

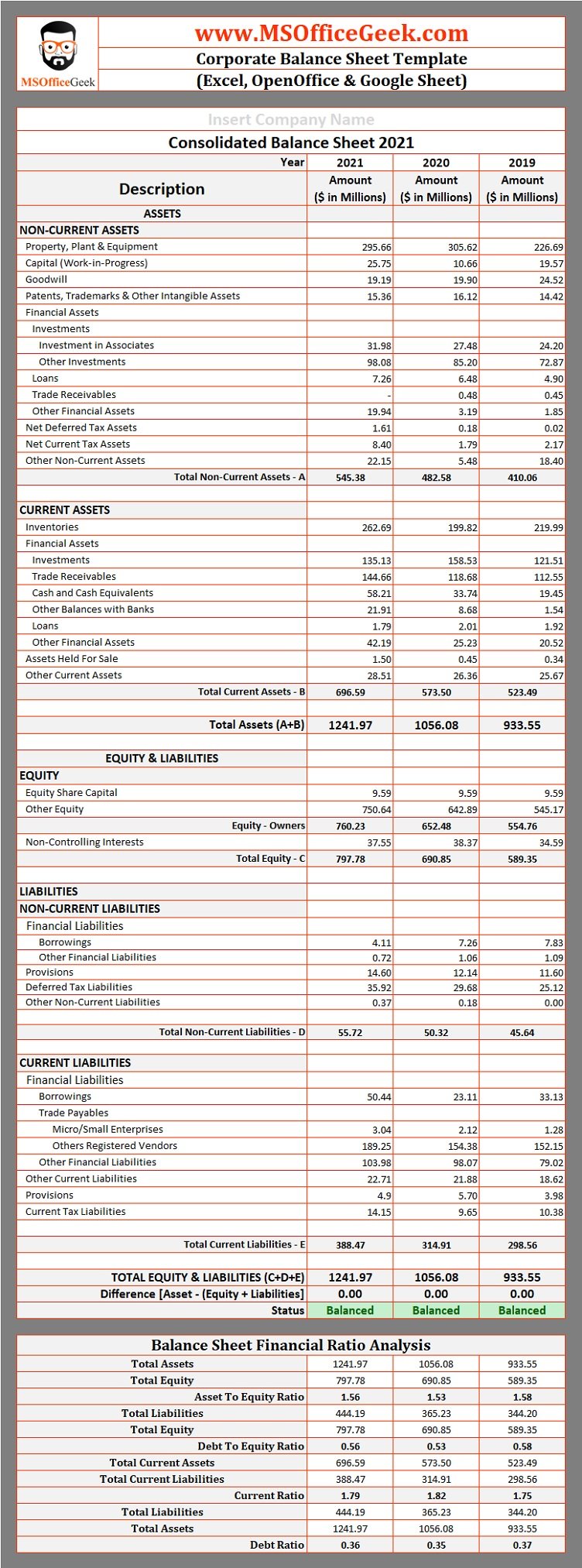

Corporate Balance Sheet Template

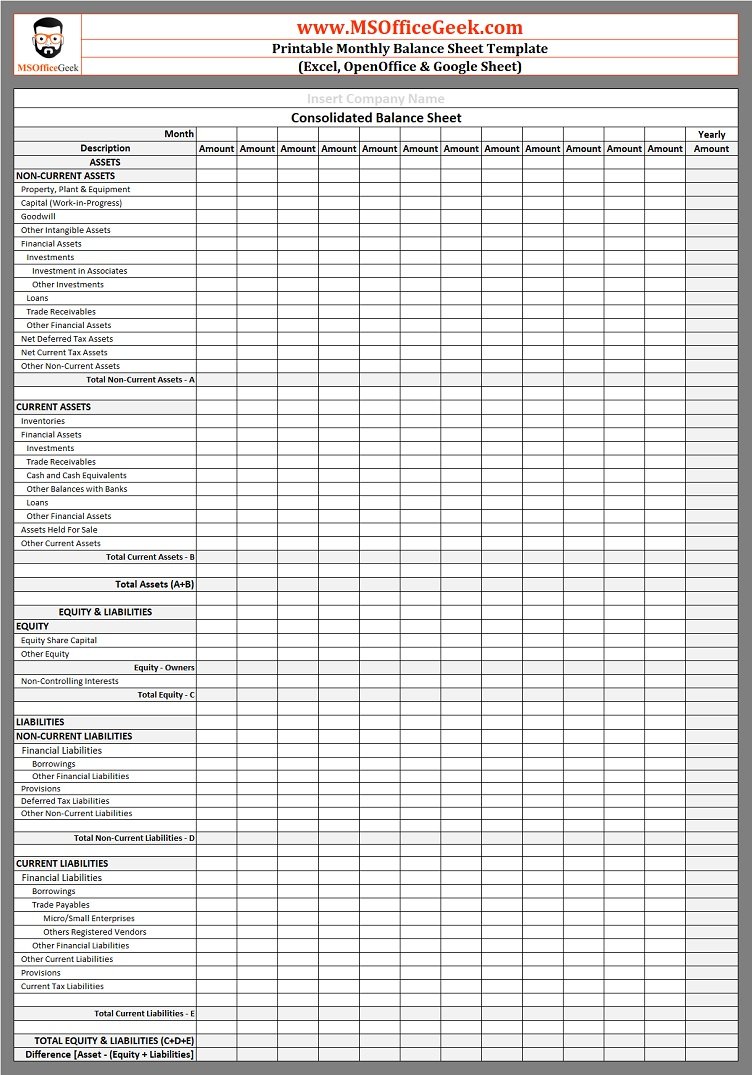

Monthly Balance Sheet Template

Balance Sheet Horizontal Analysis Template

Balance Sheet Vertical Analysis Template

Additionally, you can also download templates like Accounts Payable Template, and Accounts Receivable Template, Payroll Template With Attendance, Salary Slip Excel Template India, Simple Salary Sheet, and Employee Salary Sheet depending on the company requirement.

Feel free to contact us for the customization of this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

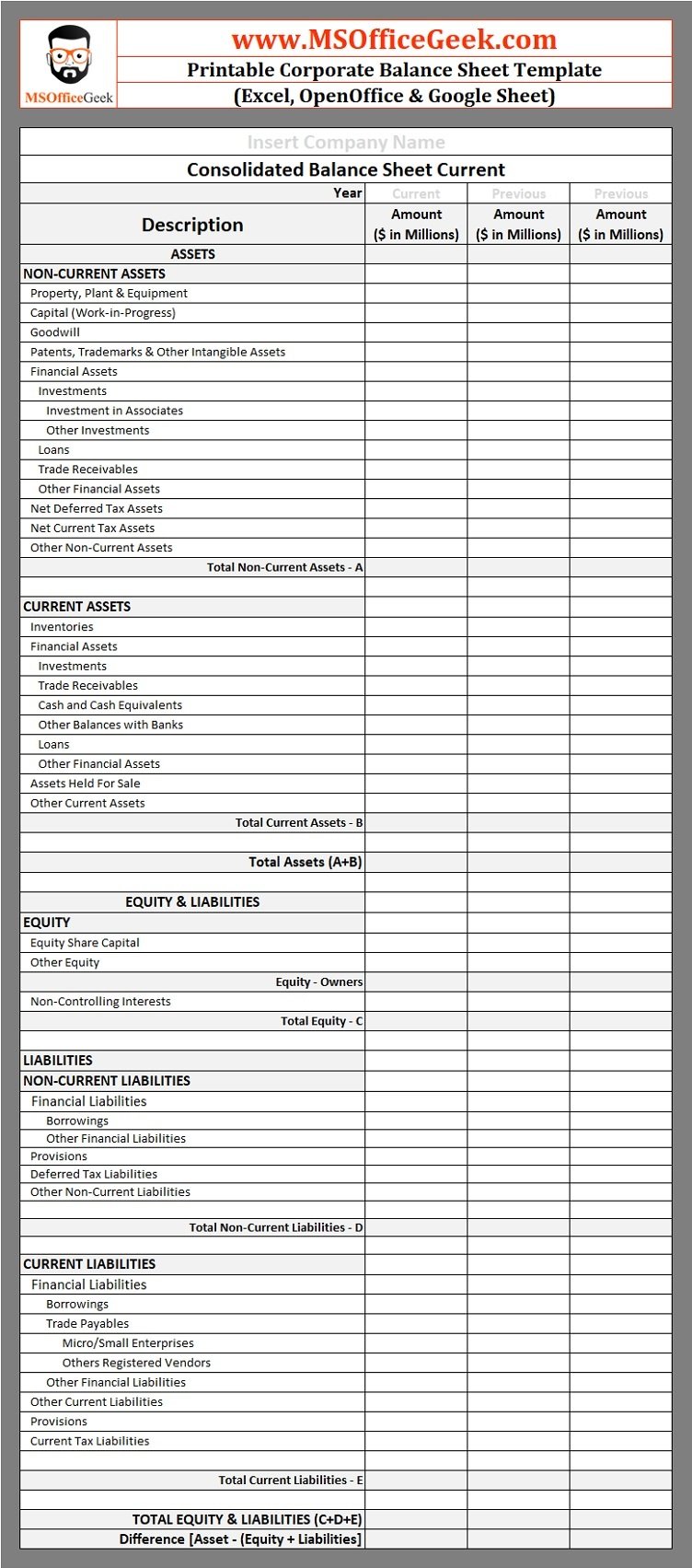

Printable Balance Sheet Templates

In addition to the above, there you can also download and print three different Printable Balance Sheet templates given below.

Printable Simple Balance Sheet Format

Click on the image to enlarge and print the Simple Balance Sheet:

Printable Corporate Balance Sheet Format

To print the Corporate Balance Sheet, click on the image below and print:

Printable Monthly Balance Sheet Format

Click on the image to enlarge and print the Monthly Balance Sheet:

How To Use Balance Sheet Template?

This template consists of 3 Balance Sheet templates and 2 Financial Analysis Templates. Download the desired template and follow the below-given steps:

- Insert line items of Assets applicable to your business. This includes current assets and non-current assets.

- Enter applicable Liabilities of the business. These include current liabilities as well as long-term non-current liabilities.

- Insert Shareholder’s equity as per the book of accounts.

That’s it. The sum of all assets must equal the sum of liabilities and shareholder’s equity. If the total matches the template displays “Balanced” in green and if it doesn’t then “Recheck” in red.

Moreover, based on the data inserted, the temple performs ratio analysis of the balance sheet. This helps the management to see the performance of the company during the period.

Balance Sheet Ratio Analysis includes the following:

Debt to Equity Ratio

Asset To Equity Ratio

Current Ratio

Debt Ratio

In addition to the above, copy and paste data from your balance sheet to the horizontal analysis template and vertical analysis template.

The template consists of predefined formulas and will automatically perform the horizontal and vertical analysis of the balance sheet for you.

How To Analyse A Balance Sheet?

There are two ways to analyze a balance sheet: Horizontal Analysis (Trend Analysis) and Vertical Analysis (Common-size Analysis).

Horizontal Analysis of Balance Sheet

Horizontal Analysis is the method of comparing financial statements of different accounting periods. Financial Analysts use this method to analyze historical trends. Thus, it is also known as Trend Analysis.

The purpose of horizontal analysis is to determine an increase or decrease in line items of two different periods. As the name suggests, the values are horizontally compared and the variance is displayed in percentage.

Such analysis reveals the changes in operational activities which provide a clear picture of business performance. It helps the management to identify problems and strengths of the business by looking at critical business performance.

It also helps to know that does a company has sufficient liquidity or not at any given time. Moreover, the Horizontal analysis depicts growth rates and profitability over a specific period.

How to Perform Horizontal Analysis of a Balance Sheet?

To perform Horizontal Analysis, you require data of two consecutive years of the same company or two companies from the same industry.

Define the base year and then find the variance between line items. Usually, the current year is taken as the base year. The formula to find the variance is as follows:

Variance = Line Item Later Period – Line item Base Period

Now, convert the variance to a percentage by dividing the variance amount of the line item by the line item of the base year.

Variance Percentage = Line Item Variance / Line Item Base Year X 100

It displays the movement of activities like revenues, expenses, etc of the financial statements for the comparative periods. Usually, investors and companies use it while planning for investment or buying a business.

Vertical Analysis of Balance Sheet

Vertical analysis is the method to analyze the relative percentage change over a period. It is also known as a common-size analysis.

In this method, each line item shows a percentage of a base figure within the statement. This helps us to understand the contribution of the line items in building assets, liabilities, and shareholder’s equity.

Usually, analysts perform the vertical analysis for a single period. This helps them to understand the proportionate value of each line item against the total account balances.

How to Perform Vertical Analysis of a Balance Sheet?

To perform Vertical analysis, the main items of the Balance sheet are taken as base figures for the respective line items. Assets, liabilities, and shareholder’s equity.

Each item from assets, liabilities, and shareholder equities is shown as a percentage of the base figure. Use the following formula:

Assets Section = Line item of asset / Total Assets

Liabilities and Shareholder’s Section = Line Item of Liabilities / Total Liabilities + Total Shareholder’s Equity)

You can also use multiple years for comparative analysis.

Balance Sheet Financial Ratios

Below are some important balance sheet ratios that help us to analyze the balance sheet of a given period.

Debt to Equity Ratio

The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity.

The D/E ratio is an important metric used in corporate finance. It is a measure of the degree to which a company is financing its operations through debt versus wholly-owned funds.

More specifically, it reflects the ability of shareholder equity to cover all outstanding debts in the event of a business downturn. The debt-to-equity ratio is a particular type of gearing ratio.

Source: Investopedia

Use the following formula to calculate the Debt to Equity Ratio:

D/E = Total Liabilities / Total Shareholder’s Equity

Asset To Equity Ratio

The Assets to Equity Ratio shows the relationship of the Total Assets against the portion owned by shareholders. It indicates the level of the company’s leverage.

Use the following formula is to calculate Asset to Equity Ratio:

Asset To Equity Ratio = Total Assets/Shareholder’s Equity

A relatively high ratio indicates more assets and lower equity levels. This means that the company has borrowed money to sustain itself in business. Moreover, a high Asset to Equity ratio also means that the cost f capital is higher than the return on borrowed capital.

Current Ratio

The current ratio is a liquidity ratio that helps measures the ability of the business to pay current due within the preceding year.

It helps the investors and lenders the efficiency of the business to maximize the current assets against its current debt and other payables.

As the name suggests, the Current Ratio takes into consideration all current assets and current liabilities. It is also known as the working capital ratio.

Use the following formula to calculate the Current Ratio:

Current Ratio = Total Current Asset / Total Current Liabilities

Lower current ratios depict the inefficiency of the management in using its assets. Thus, there is a higher risk of default in such companies. Higher current ratios are considered to be good.

Debt Ratio

The debt ratio is a type of solvency ratio that helps to measures the percentage of total liabilities against total assets.

In simple terms, it shows the ability of a company to pay all liabilities with its assets. A higher liabilities indicate more risk for investors/lenders.

Use the following formula to calculate the Debt Ratio:

Debt Ratio = Total Liabilities / Total Assets

The Debt Ratio provides insights into the overall debt burden on the company and its ability to pay off the debt in near future.

Benefits of Balance Sheet

- A balance sheet provides the complete financial position of the business.

- It assists in calculating many important financial ratios like profitability, liquidity, and sustainability.

- It provides a detailed overview of the solvency position of the company.

- A strong balance sheet plays an important role in raising equity and as well as getting loans.

- Projects the owner’s share as well as equity in the business at a given period.

- With detailed Financial Analysis, it helps the management to identify and rectify major issues.

- It also helps in preparing plans based on the analysis.

Limitations of Balance Sheet

- One of the major limitations of the balance sheet is that it displays only the acquired assets. Assets under research and development are ignored.

- Moreover, investments in research and development impact the current finances of the company.

- It records the value of the assets at historical value. Thus, actual value assets value is not projected.

- Usually, depreciation is calculated as per industry standards. Hence, it does not reflect the actual wear and tears, especially of plants and equipment.

Frequently Asked Questions

What is the function of a balance sheet?

A balance sheet provides a summary of all business assets and liabilities. The main function, in general, is to know how much money will be left selling all our assets and paying off all our debt.

What are the 4 different formats of the balance sheet?

The 4 different formats of the balance sheet are Classified Balance Sheet, Common-Size Balance Sheet, Comparative Balance Sheet, and Vertical Balance Sheet.

What is the most important part of the balance sheet?

The top-line asset cash and cash equivalent items are the most important part of the balance sheet for owners as well as investors. Other important items are receivables and short-term investments, property. Moreover, current liabilities also are important.

What makes a strong balance sheet?

For an SME, excess assets against liabilities make a balance sheet strong. Whereas, for a corporate, a strong balance sheet is structured in such a way that it supports the financial goals and maximizes financial performance.

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.