Salary Slip Excel Template – India in Excel, Google Sheets, and OpenOffice Calc that helps you prepare employee salary slips in minutes.

This template consists of 2 types of salary slips: Simple Salary Slip and Corporate Salary Slip. These salary slips are designed based on the Indian Salary structure. Simple and easy to use. Just enter the credentials and your payslip is ready.

Table of Contents

Download Free Simple Salary Slip Excel Template India (Excel, OpenOffice Calc, and Google Sheet)

Download Free Corporate Salary Slip Excel Template India (Excel, OpenOffice Calc, and Google Sheet)

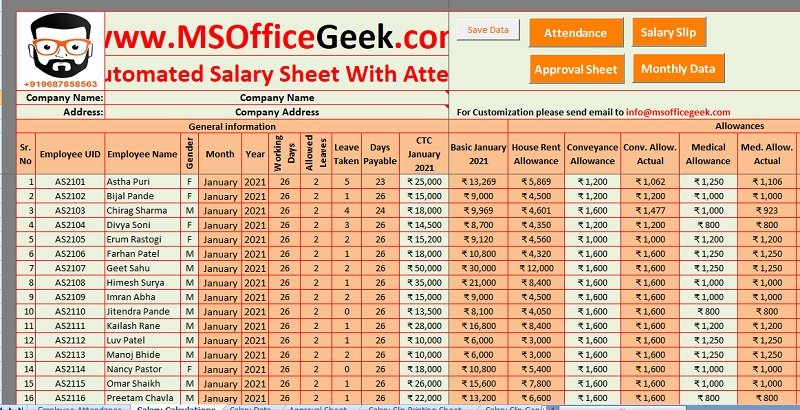

You can also download a fully automated Payroll Template With Attendance to easily perform all your payroll tasks.

Components of Simple Salary Slip Excel Template

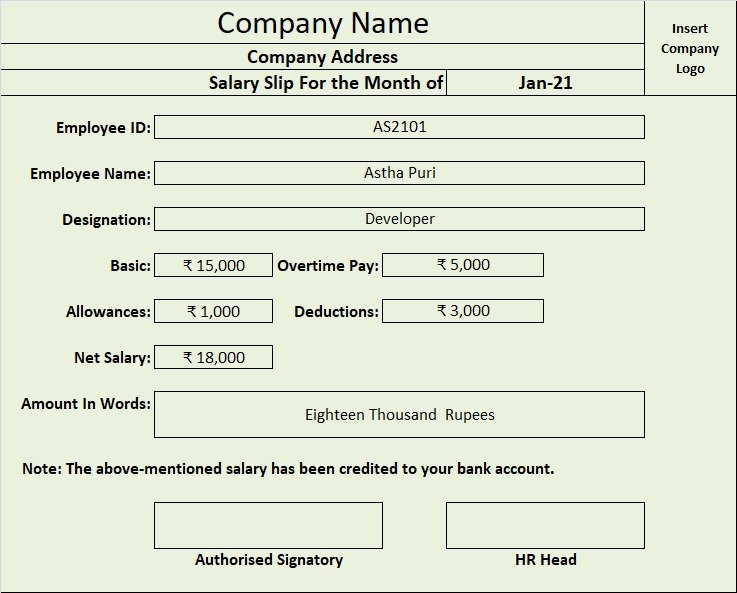

Simple Salary Slip is a basic employee payslip without the bifurcation of allowances and deductions. The user needs to enter the sum of all allowances as well as the deductions.

There are two types of data to enter in this template. You need to enter the company information one time. Whereas the employee details and salary amounts will change for each employee every month.

This template is useful for SMEs where the size of the organization is small. Usually, these SMEs don’t deduct TDS or other taxes.

How To Use Simple Salary Slip Excel Template – India?

- Insert ” Company name” as well as “Company Address”. You need to enter this information only one time.

- Enter the month for which you are preparing the Salary Slip. This cell consists of a predefined Date format. Enter the first date of any month and it will display as shown above. In case, this doesn’t work in your file, then right-click the cell and select “Format cells”. In the format cells window, click on Custom format on the left side of the window. Select “mmm-yy” from the options or manually mmm-yy type it without punctuation marks.

- Insert Employee ID. Employee Id is a unique number to identify employees.

- Type-In Employee Name.

- Enter the Designation of the employee.

You can automate these 3 cells by creating a drop-down menu using the Data validation function for employee name, employee id, and designation. - Insert basic salary, the sum of allowances, overtime pay, and the sum of deductions.

- Net Salary cell auto-calculates the value as it consists of a predefined formula.

Net Salary = Basic + Allowances + Overtime – Deductions - Amount in words uses SpellNumber Indian Rupees Excel Function which is manually inserted into the excel file. In OpenOffice Calc uses NUMBERTEXT Function add-in. Whereas the Google Sheet also uses Spell Number Indian Rupees script manually inserted through App Script. Follow the instruction to insert the same in your OpenOffice Calc as well as Google Sheet files.

- Now click on the “Print” button on the top right and print the salary slip. Get it signed and approved by the authorities.

Your simple salary slip is ready.

Components of Corporate Salary Slip Excel Template – India

A Corporate Salary Slip is a detailed employee payslip generally used by bigger companies and corporates.

It consists detailed description of each type of allowances like conveyance, medical, special, etc. It also consists of bifurcation of deductions such as professional tax, TDS, salary advances, etc.

This sheet consists of predefined formulas. Hence, all you need to do is to enter the company details, employee details, and CTC of the employee.

It auto-calculates the Basic Salary, House Rent Allowance(HRA), Allowances, Deduction, and extra remunerations using the formulas. These formulas can be changes according to the company policy. This template is useful for corporates and bigger-sized companies.

Let’s understand how to use this corporate salary slip in detail.

How To Use Corporate Salary Slip Excel Template – India?

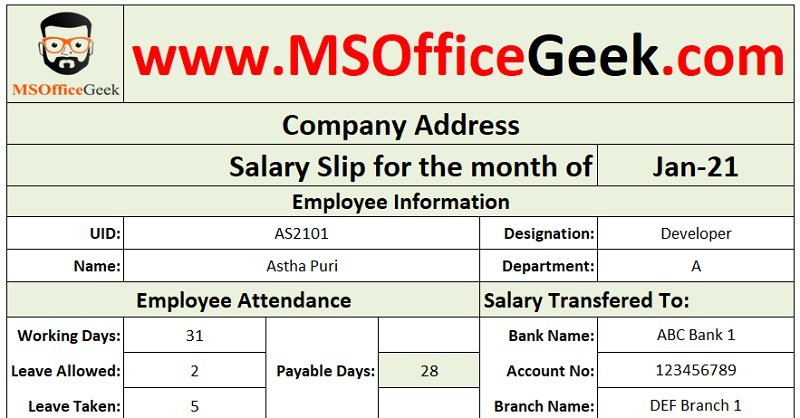

This template consists of 5 sections: Company Credentials, Employee Information, Employee Attendance, Employee Bank Details, Salary Calculation Section, and Approval Section.

Insert Company credentials such as Company name and Company Address. Insert the month for which you want to prepare the salary slip. Enter the first date of the month. The cell display a custom format of the month and year like this “Jan-21”.

In case, this doesn’t work in your file, then right-click the cell and select “Format cells”. In the format cells window, click on Custom format on the left side of the window. Select “mmm-yy” from the options or manually mmm-yy type it without punctuation marks.

In the employee information section, Insert Employee ID, Employee Name, Designation, and Department. Employee Id is a unique number to identify employees.

Additionally, you can automate these 4 cells by creating a drop-down menu using the Data validation function for employee name, employee id, designation, and department.

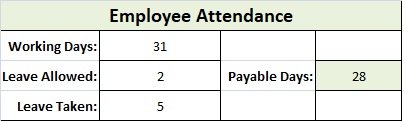

Moreover, In the Employee Attendance section, insert Working Days, Leaves Allowed, Leaves Taken. The template will calculate the Payable Days automatically with predefined formula.

If the employee hasn’t taken any leave it will display the full working days. Or else, it will deduct the leaves taken from working days and will add leaves allowed. The formula applied here is =IF(C12=0,C10,(C10-C12+C11)).

Furthermore, in the Bank Details section, insert the employee’s Bank Name, Account Number, and Branch Name to which the salary of the employee is transferred.

In the Salary Calculation section, you need to insert salary details. Most of the cells consist of predefined formulas.

CTC

Insert CTC. CTC stands for Cost to Company. “Cost to Company” means the costs borne by an employer to employ an individual.

Basic

Usually, basic salary ranges from 40%-60% of the CTC. The template calculates Basic as 60% of the basic. Just change the formula depending on company policy.

HRA

HRA or House Rent Allowance depends on different criteria like the city of residence and salary grade. According to the Income Tax Act, Section 10(13A) entitles only salaried employees for HRA.

Moreover, an employer pays HRA based on the city of residence. If an employee resides in a metro city, it is 50% of the basic salary. Whereas, if the employee resides in a non-metro city, it is 40% of basic.

This cell consists of a formula with 40%. You can change according to your company policy as well as location.

Conveyance Allowance

An employer pays Conveyance Allowance to compensate their travel to work and back respective to work location. This allowance is given only if no transportation is provided by the employer.

Insert the conveyance allowance in the inner column and the template automatically calculates the conveyance allowance based on attendance.

Medical Allowance

Generally, most corporates provide a fixed medical allowance as a part of their salary to their employees to fulfill their medical expenses. Fixed Medical Allowance is fully taxable.

Similar to the conveyance allowance, insert the medical allowance in the inner column and the template will automatically calculate the conveyance allowance based on attendance.

Others

The remaining amount of the CTC automatically displays in the Other Allowances column.

Other Allowances = CTC – (Basic + HRA + Conveyance + Medical)

If there are any other payments you can enter the amount and description in the empty column below. Check and set the formula accordingly.

Gross Salary

Gross Salary is auto-calculated. Allowances are added to the basic salary to form gross salary. Hence, Basic Salary + Total Allowance = Gross Salary.

Professional Tax

The state governments levy Professional tax working on professionals based on their salary/monthly income. Usually, it is around Rs. 200 a month. The maximum payable is Rs. 2500 in a year in India. Insert the Professional Tax amount if applicable.

TDS

This cell auto-calculates the 10% TDS if the salary is above the threshold limit. In case, the government changes the TDS percentage.

According to the IT Act in India, employers require to deduct tax at the source while making a payment, if it is above the threshold limit.

Thus, the employer has to deduct 10% of the Gross Salary. The current threshold limit is Rs. 500000 per annum for salaried employees. Hence, if the 12 months salary is above Rs. 500000 then the employer deducts 10%.

Moreover, TDS needs to be deducted irrespective of the mode of payment even if it is cash, cheque, or direct bank credit. The employer deducts the amount against the PAN Number of the employee. In case of excess TDS, the taxpayer is eligible for a refund.

Salary Advance

Manually insert the amount of salary advance if applicable to the employee in the deductions section. This sums up all the deductions.

Amount in words uses SpellNumber Indian Rupees Excel Function which is manually inserted into the excel file. In OpenOffice Calc uses NUMBERTEXT Function add-in. Whereas the Google Sheet also uses Spell Number Indian Rupees script manually inserted through App Script.

![]()

Approval Section

Your Corporate Salary Slip is ready. Now click on the “Print” button on the top right and print the salary slip.

Get it signed and approved by the authorities.

Frequently Asked Questions

Payroll expenses consist of expenses such as salaries(Basic salary and Allowances), bonuses, commissions, deductions such as EFB, PF, and EPS. In addition to that company contributions such as a company-paid health plan, and the company-paid portion of taxes are also a part of payroll expenses. Gross Salary means the sum amount of monthly payout before any kind of deductions. Gross salary consists of the following components: Gross Salary is the sum total amount that includes bonuses, overtime pay, holiday pay, reimbursements, etc before any deductions. Take-Home Salary means the amount taken home by the employee after tax and other deductions. In other words, it refers to the amount that an employee gets in-hand figure after the deductions as per the relevant company policy and local labor laws of the country. To calculate overtime for a salaried employee, you first need to find the hourly rate using the following formula: Hourly Pay For Salaried = Monthly Salary / 160 hours. Now, Multiply the hourly rate by the number of overtime hours. Employee contribution to EPF is 12% of basic salary whereas employer contribution to EPF is 3.67 % of basic salary.Payroll Expenses consists of which expenses?

What are the components of Gross Salary?

1. Basic salary

2. Medical insurance

3. HOuse Rent Allowance

4. Travel Allowance

5. Dearness Allowance ( Govt. Employees)

6. Child Education Allowance

7. Medical Allowance

8. Conveyance Allowance

9. Exgratia

10. ReimbursementsWhat is the difference between Gross Salary and Take-Home Salary?

How to calculate overtime for a salaried employee?

What are the percentage of employee provident fund contribution for employee and employer?

If you like this article, kindly share it on different social media platforms so that your friends and colleagues can also benefit from the same. Sharing is Caring.

We also design customized templates according to your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

Please send us your queries or suggestions in the comment section below. We will be more than happy to assist you.

Pingback: Ready-To-Use Cash Book Template in Excel - MSOfficeGeek