[tta_listen_btn btn_text=”Listen to this Article”]

Income Statement Projection Template in Excel, OpenOffice Calc & Google Sheet that helps to project revenues and expenses for a future period.

Moreover, this template consists of two types of Income Statement Projections: Startup Projections and Ongoing Business Projections. It also consists of Printable Income Statement Projection format.

With the help of this template, you can prepare income statement projections for a startup and also for an ongoing established business. Both calculations use different methods to calculate the projections.

This statement can be useful to businesses owners, accountants, students, etc to project the net revenue of the company based on historical data.

Table of Contents

Download Income Statement Projection Template (Excel, OpenOffice Calc & Google Sheet)

We have created 2 Income Statement Projection Templates with predefined formulas and formats. It helps you to easily project future revenues and expenses for a new startup as well as an established business.

Income Statement Projection Template – Startup

Income Statement Projection Template – Ongoing Business

Download your desired format and start using it.

Additionally, you can also download templates like Accounts Payable Template, and Accounts Receivable Template, Payroll Template With Attendance, Salary Slip Excel Template India, Simple Salary Sheet, and Employee Salary Sheet depending on the company requirement.

Feel free to contact us for the customization of this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

What is Income Statement Projection?

As the name suggests, it is a prediction of future financial activities based either on historical data of an existing company or the revenue-generating efficiency of a business startup.

A Projected Income statement is similar to an Income statement. The only difference between them is the data. The income statement consists of actual financial data at the end of any fiscal year. Whereas, a projected income statement consists of future estimates. based

Income Statement Projection Formula

Usually, a projected income statement consists of similar line items as the income statement. The only difference is that a projected income statement uses the estimates of future revenue from sales and services as well as operational expenses.

Projected Income = Estimated Revenues – Estimated Expenses – Estiamted Taxes

Importance of Projected Income Statement

Financial projections are key to the successful management of any business. Based on such projections, management can take important financial decisions. These include the launching of new products, defining the production schedule of products, increasing or decreasing overhead expenses, define product prices, etc.

Moreover, they are a vital part of any business plan for investors as well as lenders. Either you are looking to expand your business or commence a business, investors, and lenders look for the revenue-generating capacity of the business.

The main purpose of Income Statement Projection is to define a business’s future income based on thorough assumptions.

Usually, corporates prepare projections to define strategies for expansion of business and achieve revenue goals. Startups use an Income Statement Projection for investors to money for their business.

Moreover, businesses also use such projections to the feasibility of products or projects before launch/commencement.

Additionally, it serves as a barometer to define the transaction cycle. A transaction cycle means the time taken to produce, market, sell and receive payment.

Furthermore, it helps the management to manage the workforce efficiently eventually saving unnecessary overhead costs. Important decisions in favor of the business are made based on such projections.

Proper projections help in the planning process. Such projections provide an overview of the amount of debt or equity required by the business shortly.

Types of Income Statement Projections

Financial projections can be short-term as well as long-term.

Short-Term Projections

Short-term projection covers a breakdown of monthly projections over a year. They are used for internal purposes to identify growth opportunities and the smooth running of the business.

Long-Term Projections

Whereas, long-term projections cover a 3-5 years plan. They are mostly used to obtain financial services from institutions like banks and NBFCs. In addition to that, it also helps in attracting investors.

Methods of Preparing Projected Income Statement

There are 2 different methods to prepare Projected Income Statements based on the type of business.

- Startup Projection

- Ongoing Business Projection

These methods are based on the age of business. A commencing business uses the startup projection method whereas an existing business uses an ongoing business projection method.

Start-up Business Projection

Unavailability of previous performance makes it difficult for startup owners to To prepare projected financial statements. In such cases, startup owners used an assumption based on product line and sales funnel to project the revenue-generating efficiency of the business.

Thus, it is advisable for a startup owner neither to be too conservative nor aggressive. A thorough projection includes both aggressive and conservative scenarios. In simple terms, provide optimistic as well as cautious scenarios in your projections.

Ongoing Business Projection

An ongoing business projection is based on the performance of the business in previous years. Hence, using data from the previous years makes the projection easy.

Moreover, such projections are trustworthy because they show a proven record of the achievements of the business. Eventually, it increases the credibility of your business plan in the eyes of investors or lenders. It is advisable to prepare financial projections based on industry trends.

Components of Income Statement Projection Template

This template consists of 3 files: Income Statement Projection Template for Startup, Income Statement Projection Template for Ongoing Business, and Printable Format of Income Statement Projection.

Let us understand each template in detail.

Income Statement Projection Template for Startup

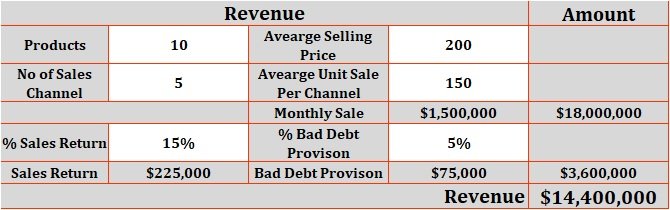

This template consists of 5 sections: Revenues, COGS, Operating Expenses, Other Expenses, and Tax Expenses.

As we have to assume the revenue for a new startup, this section consists of a detailed breakdown of possible revenue streams.

No of Products

Average Selling Price

No of Sales Channel

Average Unit Sale Per Channel

Inserting the above date will give you the Gross Revenue.

Insert the following to derive Net Revenue:

% of Sales Return

% of Bad Debts

Inserting the percentage will calculate the amount of Sales return and bad debt allowance.

COGS section consists of the following:

Inventory – Opening Balance

Purchases

Inventory – Closing Balance

Dead Stock

Insert percentage assumption for each and it will calculate the amounts for you.

Applying the below formula the template derives COGS:

Inventory – Opening Balance + Purchases – Inventory – Closing Balance – Dead Stock

The template displays Gross Profit by subtracting COGS from Gross Revenue.

Operating Expenses section consists of the following:

Payroll Expenses

Advertising Expenses

Marketing Expenses

Office Expenses

Utilities

Insurance Premiums

Miscellaneous Expenses

License Fees

Interest Paid on Loans

You can change the description based on the nature of your business. It automatically sums up the total operating expenses.

Other expenses include Depreciation and amortization expenses. To calculate depreciation, insert the depreciable assets value and applicable depreciation percentage.

Insert monthly amortization schedule. The template displays an assumption of yearly depreciation expenses as well as amortization expenses.

To derive Profit Before Taxes, the template uses the following formula:

Profit Before Taxes = Gross Profit – Operating Expenses – Other Expenses

The tax section consists of the applicable yearly tax percentage and the template will automatically calculate the tax amount.

To derive Net Projected Income, the template uses the following formula:

Projected Income = Profit Before Taxes – Estimated Tax Expenses

Your projected Income Statement for a startup is ready.

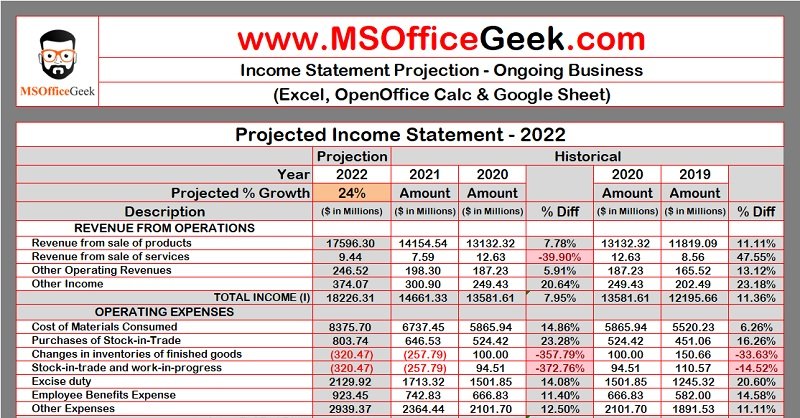

Income Statement Projection Template for Ongoing Business

In an ongoing business, the historical data is compared to previous years to get an idea about the performance of the business.

With the help of this template, you can compare data of 3 prior years to project income for the upcoming year. This template compares the figures and provides the percentage increase or decrease against the teaching line item.

Based on this comparison, either you can insert an average % of projection or you can manually insert the figures.

This template consists of 6 sections: Revenues from Operations, Operating Expenses, Non-Operating Expenses, Tax Expenses, and Other Comprehensive Income.

Operating Revenue Section:

Revenue from sale of products

Revenue from sale of services

Other Operating Revenues

Other Income

The sum of all the above items equals total income.

Operating Expenses Section:

Cost of Materials Consumed

Purchases of Stock-in-Trade

Changes in inventories of finished goods

Stock-in-trade and work-in-progress

Excise duty

Employee Benefits Expense

Other Expenses

The sum of all the above items equals total expenses.

The difference between total income and total revenue is the net revenue. It is known as EBITDA. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

Non-Operating Expenses:

Finance Costs

Depreciation and Amortization

Subtracting this from EBITDA gives us Profit Before Tax.

Tax Expenses

Current Tax

(Excess)/Short Tax provision for earlier years

Deferred Tax

Subtracting this from Profit Before Tax gives us Profit After Tax.

Yet, the calculations aren’t finished. We need to add income from the OCI section. OCI stands for Other Comprehensive Income. These incomes are added incomes from non-operating sources such as tax benefits from the government, returns of Benefit Scheme of Employees invested, etc.

Other Comprehensive Income Section:

Benefit from Defined Benefit Plan

Tax on Defined Benefit Plan

Gain/Loss on investments in equity instruments

Gain/Loss on investments in debt instruments

Income tax benefit on investments in debt instruments

This may vary from company to company. It should be kept in mind that you need to insert negative figures with negative signs wherever subtracted.

Adding this to the Profit After Tax gives us Net Profit or Loss of the company.

Income Statement Projection – Printable Format

Click on the image to print the Income Statement Project Printable format:

For more information on Income Statement Projection click the link below:

Rules To Follow While Forecasting Income Statement

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.