Download Employee Retention Credit Calculator 2021 in Excel, OpenOffice Calc, and Google Sheets for businesses affected by COVID-19 in the US.

With the help of this template, you can check eligibility for ERC as well as calculate Employee Retention Credit for each quarter of Tax Year 2021.

Let’s get started.

Table of Contents

What is Employee Retention Credit?

In the past 2 years, businesses had to mandatorily shut down operations during COVID-19. As a result, the US government introduced Coronavirus Aid, Relief, and Economic Security Act hereafter referred to as CARES Act.

The CARES Act consists of a business relief provision known as the Employee Retention Credit (ERC). This credit entitles the businesses to a refundable payroll tax credit for qualified wages paid to retained full-time employees.

The ERC’s objective is to motivate firms to retain employees on the payroll even if they are unable to work due to the consequences of the coronavirus outbreak within the covered period.

The ERC is a completely refundable credit that applies to the employee’s Social Security taxes. This implies that the credit will be treated as an overpayment, and you will get a refund after deducting your portion of the taxes.

In other words, if your credit in any quarter exceeds your entire Social Security liability, the difference will be repaid to you.

To claim the new Employee Retention Credit (if eligible), total qualifying salaries and related health insurance expenditures for each quarter must be calculated and subtracted from your Form 941.

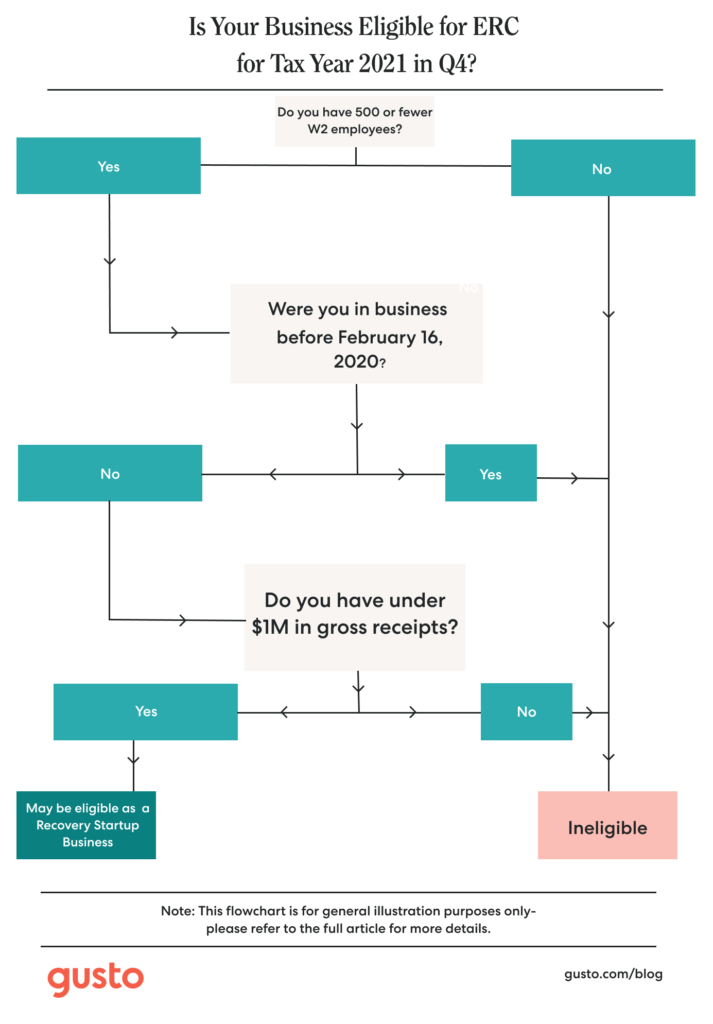

Eligibility Criteria for Employee Retention Credit 2021

There are different criteria for different quarters.

Eligibility Criteria for Q1 and Q2 of 2021 (January 1, 2021 – June 30, 2021)

- Employers must have between 1 – 500 W2 employees excluding the owners.

- Eligible businesses must have been in operation before February 16, 2020.

- Eligible employers must see a decline of 20% in gross receipts when comparing corresponding quarters in 2021 and 2019.

Source: www.gusto.com

Eligibility Criteria for Q3 of 2021 (July 1, 2021 – September 30, 2021)

- Employers must have between 1 – 500 W2 employees excluding the owners.

- Eligible businesses must have been in operation before February 16, 2020.

- Eligible employers must see a decline of 20% in gross receipts when comparing corresponding quarters in 2021 and 2019.

- Businesses that started after February 15, 2020, and have gross receipts under $1M.

Source: www.gusto.com

Eligibility Criteria for Q4 of 2021 (October 1, 2021 – December 30, 2021)

Only businesses which operate or own a Recovery Startup Business are eligible for Q4 of 2021.

- Businesses that started after February 15, 2020.

- Gross receipts under $1M.

Source: www.gusto.com

Employee Retention Credit 2021 Amount

The ERC entitles 70% of eligible salaries paid per employee, up to $7000 each quarter, and $21,000 for the whole year as a refundable tax credit for the tax year 2021.

ERC has been discontinued after September 2021. The maximum tax credit available to general employers per employee in the tax year 2021 is $21,000.

Only businesses which operate or own a Recovery Startup Business are eligible for the last quarter of 2021. Recovery Startup Businesses are those businesses that began operations after February 15, 2020, and must have gross receipts of less than $1 million. In short, only recovery startup enterprises are eligible for ERC until the end of the year.

Download Employee Retention Credit Calculator 2021

We have created an Employee Retention Credit Calculator 2021 with predefined formulas and functions. This template helps calculate ERC for each quarter of 2021.

Download by clicking below on the desired format:

Download Employee Retention Credit Calculator 2020

Additionally, you can also download other HR templates like Payroll Template With Attendance, Timesheet Template, Paycheck Calculator, Job Application Tracker, and Business Mileage Log Template, IRS Compliant Mileage Log Template depending on the company requirement.

Furthermore, feel free to contact us to customize this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

Components of Employee Retention Credit Calculator 2021

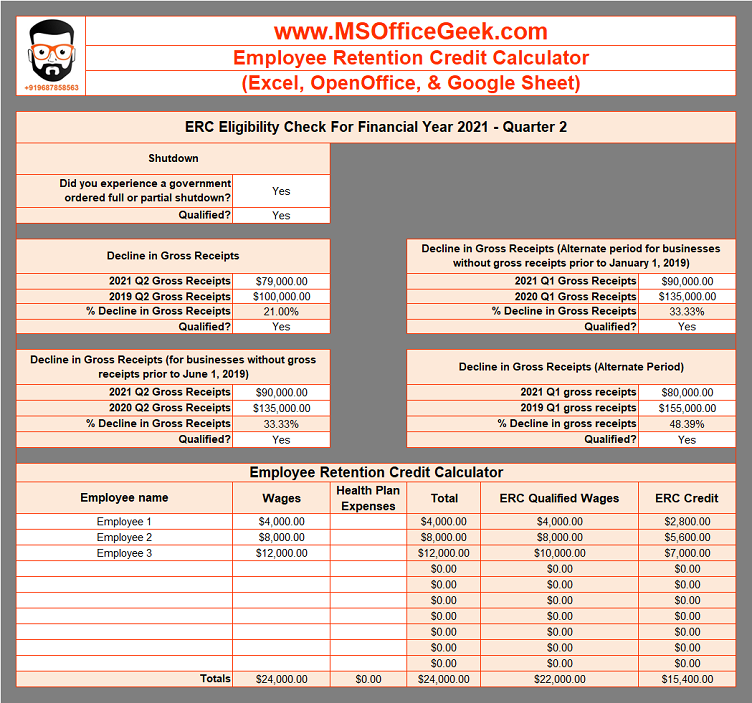

This template consists of 4 sheets for calculating ERC eligibility along with an ERC calculator. As discussed above each quarter has different eligibility criteria depending on the inception time of the business.

ERC Eligibility for 2021 Quarter 1

In Quarter 1 of 2021, if your business experienced a government-ordered full or partial shutdown then select “Yes”. If you haven’t experienced then you are not eligible for the credit.

As per the eligibility criteria, insert gross receipts for quarter 1 of 2019 and 2021 respectively. It calculates the percentage decline in gross receipts. The percentage cell auto-calculates by applying the following formula: =IFERROR(1-(D14/D15),).

For businesses that do not have gross receipts before January 2019, insert the gross receipts for quarters 1 of 2020 and 2021 respectively.

Moreover, for businesses that were established in the 3rd quarter of 2019 that before October 2019, insert Quarter 4 gross receipts of 2019 and 2020 respectively.

Furthermore, for all three scenarios, if the percentage decline in gross receipts is above 20% then it will display “Yes” otherwise “No”. If it displays “Yes” means your business qualifies for ERC.

After the Eligibility check, go to the ERC calculator below. Insert the Wages and Health Plan Expenses paid during Quarter 1 of 2021.

Qualified wages per employee are $10,000 per employee per quarter and credit available is 70% of qualified expenses, that is $7,000 per employee per quarter.

If the wages are below $10,000, you also qualify for 70% of qualified expenses.

ERC Eligibility for 2021 Quarter 2

In Quarter 2 of 2021, if your business experienced a government-ordered full or partial shutdown then select “Yes”. If you haven’t experienced then you are not eligible for the credit.

As per the eligibility criteria, insert gross receipts for quarters 2 of 2019 and 2021 respectively. It calculates the percentage decline in gross receipts. The percentage cell auto-calculates the amount by applying the following formula: =IFERROR(1-(D14/D15),).

For businesses that do not have gross receipts before January 2019, insert the gross receipts for quarters 2 of 2020 and 2021 respectively.

Moreover, for businesses that do not have gross receipts before June 2019, insert the gross receipts for quarters 2 of 2020 and 2021 respectively.

Furthermore, for businesses that were established in the 3rd quarter of 2019 that before October 2019, insert Quarter 4 gross receipts of 2019 and 2021 respectively.

For all four scenarios, if the percentage decline in gross receipts is above 20% then it will display “Yes” otherwise “No”. If it displays “Yes” means your business qualifies for ERC.

After the Eligibility check, go to the ERC calculator below. Insert the Wages and Health Plan Expenses paid during Quarter 2 of 2021.

Qualified wages per employee are $10,000 per employee per quarter and credit available is 70% of qualified expenses, that is $7,000 per employee per quarter.

If the wages are below $10,000, you also qualify for 70% of qualified expenses.

ERC Eligibility for 2021 Quarter 3

In Quarter 3 of 2021, if your business experienced a government-ordered full or partial shutdown then select “Yes”. If you haven’t experienced then you are not eligible for the credit.

As per the eligibility criteria, insert gross receipts for quarters 3 of 2019 and 2021 respectively. It calculates the percentage decline in gross receipts. The percentage cell auto-calculates by applying the following formula: =IFERROR(1-(D14/D15),).

For businesses that do not have gross receipts in 2019, insert the gross receipts for quarters 3 of 2020 and 2021 respectively.

Moreover, for businesses that were established in the alternative period, insert Quarter 2 gross receipts of 2019 and 2021 respectively.

Furthermore, for all three scenarios, if the percentage decline in gross receipts is above 20% then it will display “Yes” otherwise “No”. If it displays “Yes” means your business qualifies for ERC.

After the Eligibility check, go to the ERC calculator below. Insert the Wages and Health Plan Expenses paid during Quarter 3 of 2021.

Qualified wages per employee are $10,000 per employee per quarter and credit available is 70% of qualified expenses, that is $7,000 per employee per quarter.

If the wages are below $10,000, you also qualify for 70% of qualified expenses.

ERC Eligibility for 2021 Quarter 4

The fourth quarter applies to businesses that were established after 16th February 2020. In this sheet, if both or any 1 answer is yes, you qualify for the ERC.

After the Eligibility check, go to the ERC calculator below. Insert the Wages and Health Plan Expenses paid during Quarter 4 of 2021.

Qualified wages per employee are $10,000 per employee per quarter and credit available is 70% of qualified expenses, that is $7,000 per employee per quarter.

If the wages are below $10,000, you also qualify for 70% of qualified expenses.

Frequently Asked Questions

Source: www.irs.gov

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.

Disclaimer: This article is for information and educational purpose. Information provided here shall not be treated as tax advice. Kindly consult a tax expert before filing your IRS return.

Pingback: Federal Income Tax Brackets 2022 and Tax Estimator - MSOfficeGeek

Pingback: Ready-To-Use Recovery Rebate Credit 2021 Worksheet - MSOfficeGeek

Pingback: Employee Retention Credit Calculation Spreadsheet Excel: Enhance Your Financial Planning - Employee Retention Credit (ERTC)