Download Recovery Rebate Credit 2021 Worksheet in Excel, OpenOffice Calc, and Google Sheet to easily calculate the amount of Recovery Rebate Credit.

With the help of this worksheet, you can calculate Recovery Rebate Credit for Individual taxpayers, Married Filing Separately, Married Filing Jointly, and Head of Household.

Just insert the number of dependents and the amount of 3rd Economic Impact Payments if it was partially received and the worksheet will calculate the Recovery Rebate Credit amount for you.

Table of Contents

What are Economic Impact Payments?

During the COVID-19 crisis, the US government started a relief program to help the affected Americans. The Internal Revenue Service (IRS) quickly distributed 2 direct relief payments. The third payment was issued in March 2021 through the end of the year.

Thus, Economic Impact Payments refer to the amounts received by an individual from the government as direct relief under the CARES Act.

Economic Impact Payments Eligibility

The eligibility criteria for Economic Impact Payments are as below:

- are a U.S. citizen or U.S. resident alien (and their spouse if filing a joint return), and

- are not a dependent of another taxpayer, and

- had adjusted gross income (AGI) that is not more than:

– $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

– $112,500 if filing as head of household or

– $75,000 for any other filing status

Payments were phased out – or reduced – above those AGI amounts. This means people did not receive a payment if their AGI was at least:

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household

- $80,000 for any other filing status

Source: www.irs.gov

EIP Amounts for Tax Year 2021

Under the CARES Act, the government provided Economic Impact Payments EIP of up to $1,200 per adult and $500 for each qualified kid under the age of 17 in March 2020 in the first disbursement.

Similarly, in the second round, the government disbursed $600 per adult and $ 600 for each qualified kid under the age of 17.

In March 2021, the IRS disbursed Economic Impact Payments of up to $1,400 individuals, $2,800 for married couples filing jointly, and $1,400 for each qualifying dependent. Qualifying dependents include all dependents, such as college students, parents, and other qualifying relatives including adults.

What is Recovery Rebate Credit?

Recovery Rebate Credit is a program that IRS introduces in 2021 for people who either partially received the 3rd EIP or stimulus payment or did not receive it at all. Therefore, such individuals can claim any missing amounts from the third EIP through the Recovery Rebate Credit (RRC).

In simple terms, if you didn’t receive the full amount of the 3rd Economic Impact Payment, you could be entitled to the 2021 Recovery Rebate Credit.

To claim it, you’ll need to submit a 2021 tax return – even if you don’t normally file taxes. Your 2021 Recovery Rebate Credit will either decrease or be included in your tax refund for 2021.

Recovery Rebate Credit Eligibility

Generally, taxpayers are eligible to claim the Recovery Rebate Credit if they:

- were a U.S. citizen or U.S. resident alien in 2021,

- are not a dependent of another taxpayer for the tax year 2021, and

- have a social security number valid for employment that is issued before the due date of their 2021 tax return (including extensions).

Source: www.irs.gov

The credit has an AGI phase-out limitation. For married filing jointly or qualifying widow(er), the Phase-out begins at $ 150,000 and ends at $160,000.

Moreover, for individuals filing as head of household, the AGI phase-out begins at $112,000 and ends at $120,000. Similarly, for single filers or married couples filing separately, the phase-out begins at $75,000 and ends at $80,000.

Download Recovery Rebate Credit 2021 Worksheet (Excel, OpenOffice Calc, & Google Sheet)

We have created a Recovery Rebate Credit Calculator with predefined formulas and functions. This template helps calculate RRC for the tax year 2021.

Download by clicking below on the desired format:

Additionally, you can also download other useful templates like Employee Retention Credit Calculator 2021, Payroll Template With Attendance, Timesheet Template, Paycheck Calculator, Job Application Tracker, Business Mileage Log Template, and IRS Compliant Mileage Log Template.

Furthermore, feel free to contact us for the customization of this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

Components of Recovery Rebate Credit 2021 Worksheet

This template consists of 3 sections depending on the filing status.

- Single or Married Filing Separately.

- Married Filing Jointly.

- Head of Household.

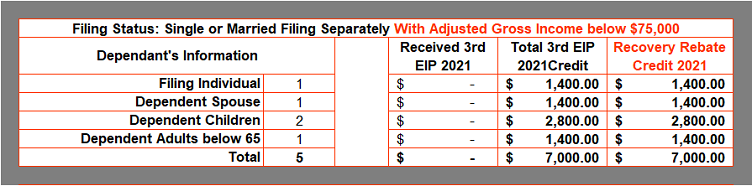

RRC Calculations for Single or Married filing Separately

This section is for people filing single or married couples filing separately.

On the left-hand side, insert the dependent’s information. Insert the number of the dependent spouses, children, and elders below 65.

Insert amount received for 3rd EPI against each dependent. If you haven’t received then insert 0. As we know the credit for 2021 is $1,400, the second column shows the 3rd EPI amount. The third column displays the difference.

The template automatically calculates the Recovery Rebate Credit for you.

It should be kept in mind that for single filers or married couples filing separately, the phase-out begins at $75,000 and ends at $80,000. Thus, if your AGI is above that you are not eligible for Recovery Rebate Credit.

RRC Calculations for Married filing Jointly

This section is for married couples filing jointly.

On the left-hand side, insert 2 for filing individuals under the dependent’s information. Insert the number of the dependent children, and elders below 65.

Insert amount received for 3rd EPI against each dependent. If you haven’t received then insert 0. As we know the credit for 2021 is $1,400, the second column shows the 3rd EPI amount. The third column displays the difference.

Furthermore, for married filing jointly or qualifying widow(er), the Phase-out begins at $ 150,000 and ends at $160,000. Thus, AGI above this is not eligible for Recovery Rebate Credit.

The template automatically calculates the Recovery Rebate Credit for you.

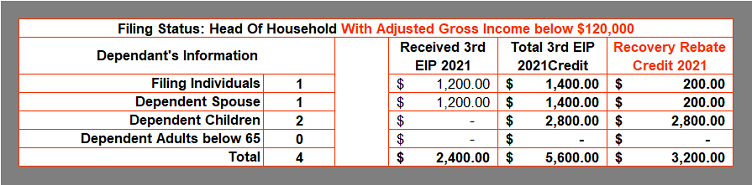

RRC Calculations for Head of Household

This section is for people filing as head of the household.

On the left-hand side, insert the dependent’s information. Insert the number of the dependent spouses, children, and elders below 65.

Insert amount received for 3rd EPI against each dependent. If you haven’t received then insert 0. As we know the credit for 2021 is $1,400, the second column shows the 3rd EPI amount. The third column displays the difference.

Moreover, for individuals filing as head of household, the AGI phase-out begins at $112,000 and ends at $120,000. Therefore, AGI above $120,000 does not qualify for Recovery Rebate Credit.

The template automatically calculates the Recovery Rebate Credit for you.

How to Claim Recovery Rebate Credit 2021?

While submitting your tax return, if you did not get the full amount of the third Economic Impact Payment, use the 2021 Recovery Rebate Credit Worksheet to figure out how much of the credit you are eligible for.

Even if you don’t generally submit a tax return, you must file one to claim the credit. Because the credit is calculated using information from your 2021 tax year, any third Economic Impact Payments you get will diminish the amount of credit you’re eligible for. Your 2021 Recovery Rebate Credit will either reduce or be included in your tax refund for 2021.

After calculating the Recovery Rebate Credit, insert the amount in point number 30 of Form 1040.

Frequently Asked Questions

Source: www.irs.gov

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.

Disclaimer: This article is for information and educational purpose. Information provided here shall not be treated as tax advice. Kindly consult a tax expert before filing your IRS return.

Pingback: Ready-To-Use Itemized Deduction Calculator 2022 - MSOfficeGeek

Pingback: Federal Income Tax Calculator 2022 - MSOfficeGeek

Pingback: Federal Income Tax Brackets 2021 and Tax Estimator - MSOfficeGeek