UAE VAT Invoice Template in Excel, OpenOffice Calc, Google Sheets & PDF to issue VAT Compliant invoices to your customers.

Moreover, this template consists of auto-numbering invoices and auto-fills most of the details so that you don’t need to type in details of products and customers every time. It helps you to save time and issue an invoice in just a few minutes.

Furthermore, it consists of UAE VAT Sales Register to keep a record of invoices. You can easily generate client-wise, date-wise, and TRN-wise reports.

Table of Contents

VAT Regulations For UAE VAT “Tax Invoice”

With the implementation of VAT since January 2017, every registered person has to issue a VAT-compliant Tax Invoice to customers.

Federal Tax Authority has issued some regulations and notifications for Tax invoices. These regulations are given below for your easy reference.

According to Article 59 of Executive Regulations under Cabinet Decision No. 52, Point number 1 a Tax invoice must contain the following details:

- The word “Tax Invoice” is displayed on the invoice.

- The name, address, and Tax Registration Number of the Registrant making the supply.

- The name, address, and Tax Registration Number of the Recipient where he is a Registrant.

- A sequential Tax Invoice number or a unique number enables identification of the Tax Invoice and the order of the Tax Invoice in any sequence of invoices.

- The date of issuing the Tax Invoice.

- “Date of supply” if it is different from the date the Tax Invoice was issued.

- A description of the Goods or Services supplied.

- For each Good or Service, the unit price, the quantity or volume supplied, the rate of tax, and the amount payable must be expressed in AED.

- The amount of any discount offered.

- The gross amount payable must be expressed in AED.

- The Tax amount payable must be expressed in AED together with the rate of exchange applied where the currency is converted from a currency other than the UAE dirham.

- Where the invoice relates to a supply under which the Recipient of Goods or Recipient of Services is required to account for Tax, a statement that the Recipient is required to account for Tax, and a reference to the relevant provision of the Decree-Law.

Source: www.mof.gov.ae

Download UAE VAT Invoice Template (Excel, OpenOffice Calc, Google Sheet & PDF)

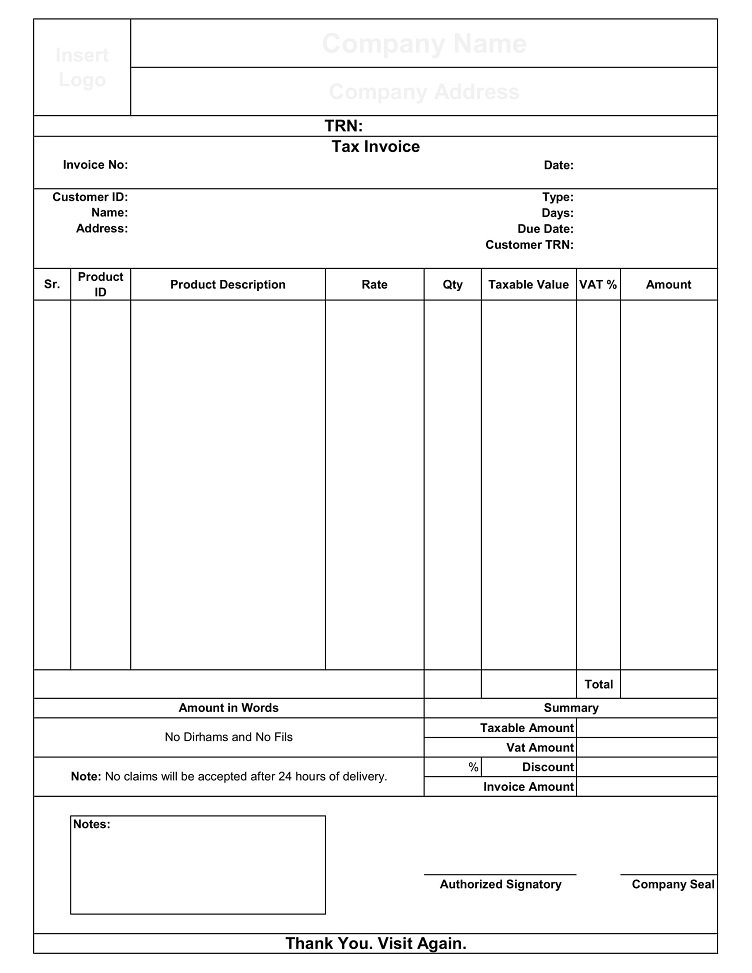

Keeping in mind the above regulations, we have created a Fully Automated UAE VAT Invoice Template in English and Arabic with predefined formulas and functions. Issue a Tax Invoice to your client in just a few minutes.

Download by clicking below on the desired format:

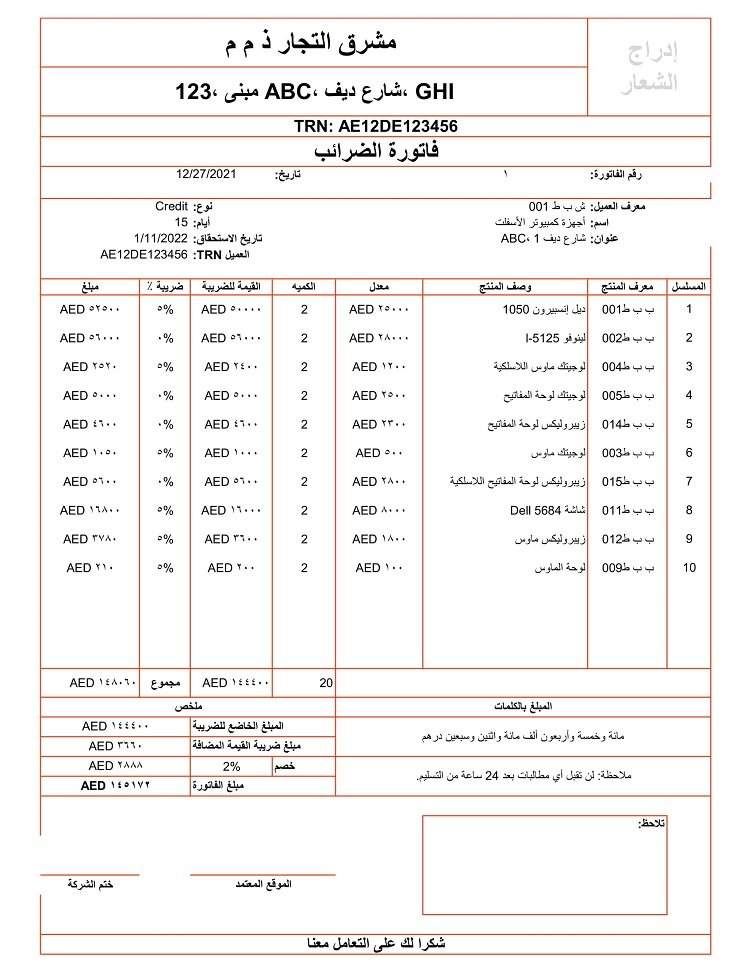

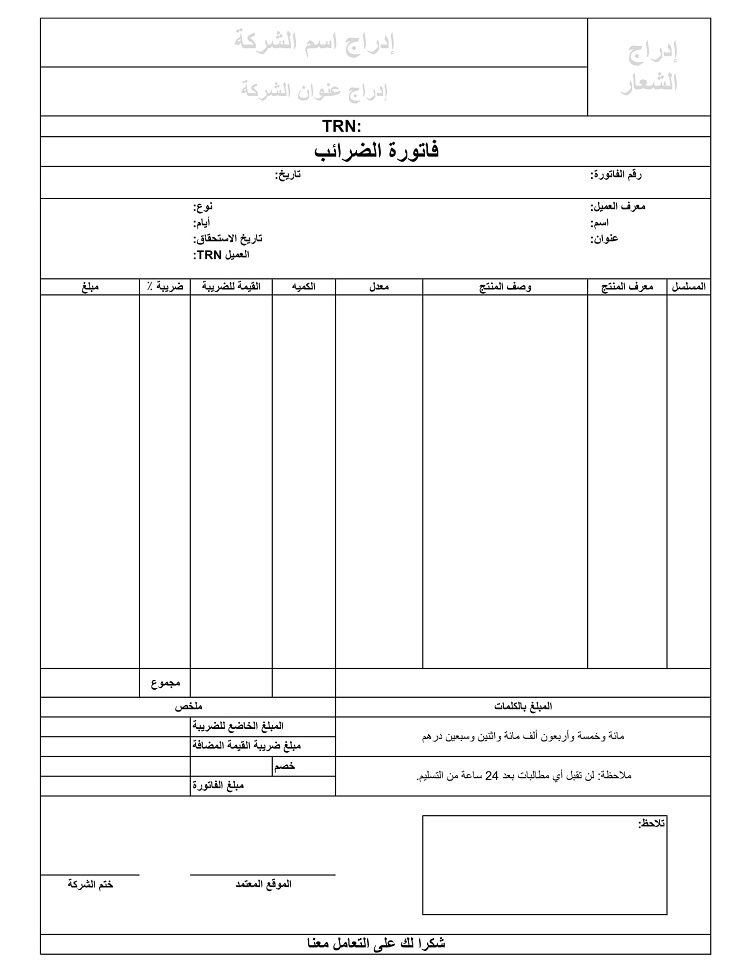

Download UAE VAT Invoice Template in Arabic (Excel, OpenOffice Calc, Google Sheet & PDF)

Download by clicking below on the desired format:

Additionally, you can download Accounting templates like Inventory Template, Accounts Payable Template, Cash Book Template, Petty Cash Book Template, Marketing Budget, Expense Report Template, and Payroll Template With Attendance.

Feel free to contact us for the customization of this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

How to Use Fully Automated UAE VAT Invoice Template?

- Insert data in all the sections of the Invoicing Setup File.

- Go to UAE VAT Invoice Template.

- The date is auto-populated.

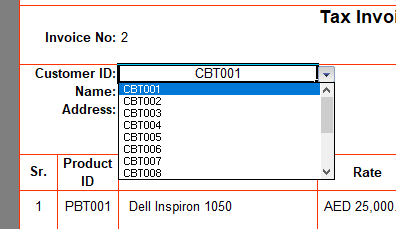

- Select the customer ID from the dropdown list and it fetches customer details like name, address, TRN, etc.

- Select type of invoice from the dropdown list: cash or Credit. If the invoice is cash the days and due date will disappear. But if the invoice is a credit invoice, then it automatically fetches days and due dates according to the credit period defined in the setup file.

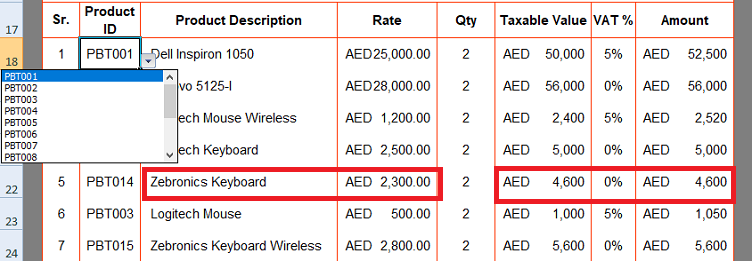

- Select product id and it auto-populates product name, rate, Taxable value, VAT percentage, and Amount. You just need to enter the quantity.

- Insert “Notes” if applicable.

- Click on the print button to print the invoice.

That’s it. Your invoice is ready.

Contents of UAE VAT Invoice Template

This template consists of 4 Sheets: Setup File, UAE VAT Invoice Template, UAE VAT Sales Register, and Printable UAE VAT Invoice Format.

Billing Setup File

The purpose of this file is to insert one-time data to save you time while issuing a Tax Invoice. It consists of the 3 sections: Supplier Information, Client Information, and Product Information.

Supplier information consists of the following:

Company Name

Supplier Address

Supplier TRN

Financial Year

Credit Period

Customer Information consists of the following columns:

Customer ID

Client Name

Client Address

Customer TRN

The Product Information section includes the following:

Product ID

Product Name

Price/Rate per Unit

VAT Rate

You can pre-define everything in this sheet and the UAE VAT Invoice template automatically fetches the data from this sheet.

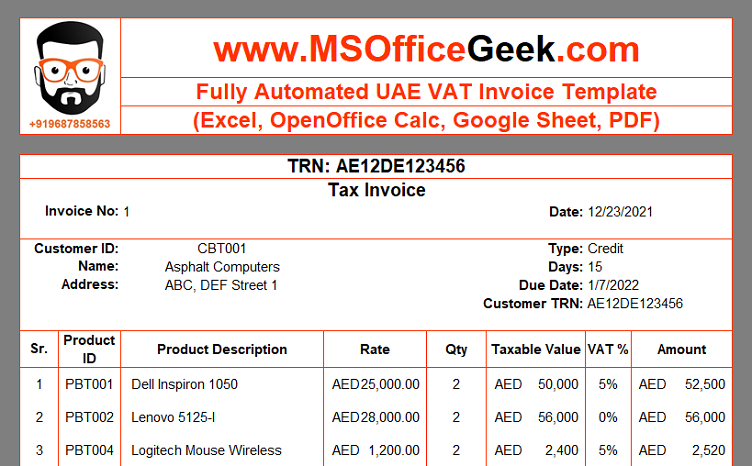

UAE VAT Invoice Template

UAE VAT invoice template consists of 4 sections: Supplier Information, Customer Information, Product Information, and Other Information.

Supplier Details

Supplier details like company name, company address, and VAT Registration number are auto-populated based on details entered in the setup file. As per the rules, the invoice consists of the heading “Tax Invoice”.

Customer Details

In the Customer Information Section, insert invoice number only for the first time. Later it will automatically generate the preceding number.

Moreover, select customer ID from the dropdown list and it auto-updates all of the following details:

Invoice Date

Customer Name

Customer Address

TRN

Type of Invoice

Credit Days

Due Date

Select the type of invoice from the dropdown list. It can be either cash or credit. If you select cash, then the credit period and the due date will disappear. Whereas, if you select the type of invoice as credit then auto-calculate the due date and display both in this section.

Product Details

Furthermore, the Product Information section consists of the following columns:

Sr.

Product ID

Product Description

Rate

Qty

Taxable Value

VAT %

Amount

The serial number is auto-populated. Select product ID and it fetches all details except the quantity. Manually insert the quantity and it will automatically populate the taxable value and amount column.

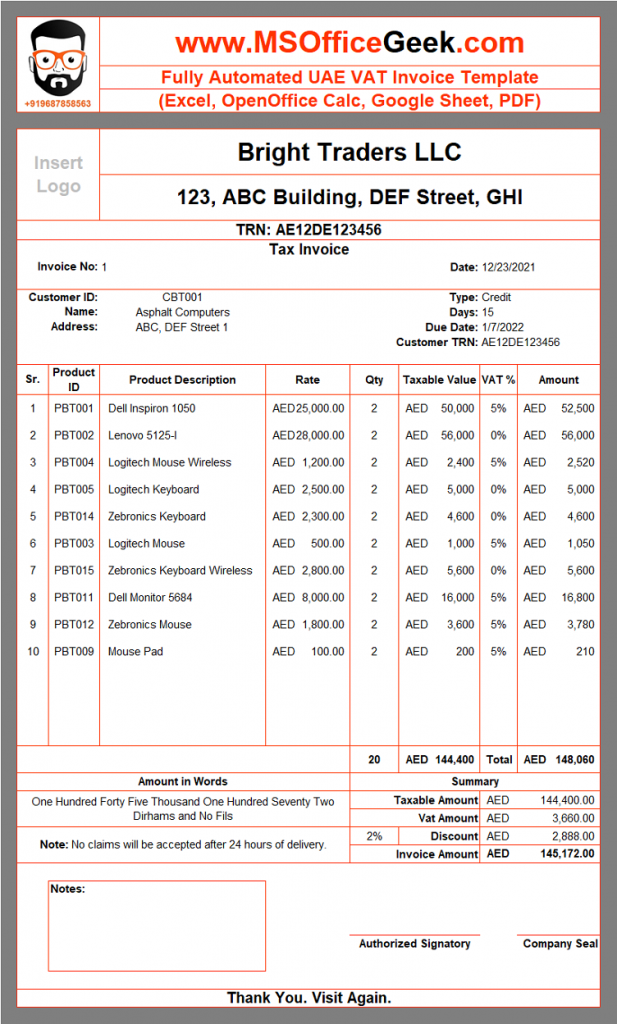

Invoice Summary and Other Information

The summary section displays the summary of the invoice. In case a discount is applicable, insert the percentage in the cell before the “discount”. It will automatically calculate the discount on the taxable value. Or else it will be blank.

Moreover, the other information section displays the invoice amount in words using the Spellnumber Function manually inserted in the file.

Furthermore, it consists of a signature section, company stamp section, and Notes along with greetings.

Click on the print button and the invoice will open the Save as PDF dialog box.

Once you execute the command the invoice number will automatically jump to next in the sequence.

UAE VAT Sales Register

After you issue the invoice and supply the goods to your customer, it is necessary to maintain client-wise records of invoices. Hence, we have created a UAE VAT Sales Register to record your invoices.

This sheet consists of the following details:

Date

Invoice No.

Customer ID

Customer Name

TRN Number

Taxable Value

VAT Amount

Invoice Amount

Insert date and invoice number. Select the customer ID and it will fetch the TRN number of the customer. Enter the Taxable Value and VAT Amount. The Invoice Amount column is auto-populated.

Additionally, you can generate client-wise, date-wise, and location-wise billing statements using the “Filter” option.

Printable UAE VAT Invoice Format

Click on the image to enlarge and print the Printable UAE VAT Invoice Format or Click on the button below to download as PDF:

Printable UAE VAT Invoice Format in Arabic

Frequently Asked Questions

What is the Mandatory Registration Threshold?

The Mandatory Registration Threshold for registration is AED 375,000. If the annual turnover reaches above this limit then it is mandatory for any business in UAE to register. Failing to do so can result in huge penalties.

What is Voluntary Registration Threshold?

The Voluntary Registration Threshold shall be AED 187,500. Under this provision, it is on the will of the business to register voluntarily for VAT. If the annual turnover reaches above this limit then it is mandatory for any business in UAE to register. If in case such business delays registration after reaching this limit, they should be able to provide evidence of an intention to make Taxable Supplies or incur expenses which are subject to Tax more than the Voluntary Registration Threshold.

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.

Pingback: Ready-To-Use UAE VAT Debit Note Format - MSOfficeGeek

Pingback: Ready-To-Use UAE VAT Credit Note Format - MSOfficeGeek

Pingback: Ready-To-Use UAE VAT Payable Calculator Template - MSOfficeGeek

Pingback: Ready-To-Use UAE VAT Compliant Inventory Template - MSOfficeGeek