You can get an extension to file Federal Income Tax 2022 for up to 6 months if you are busy with school, travel, or some emergency, IRS provides an extension to file till 15 October 2023.

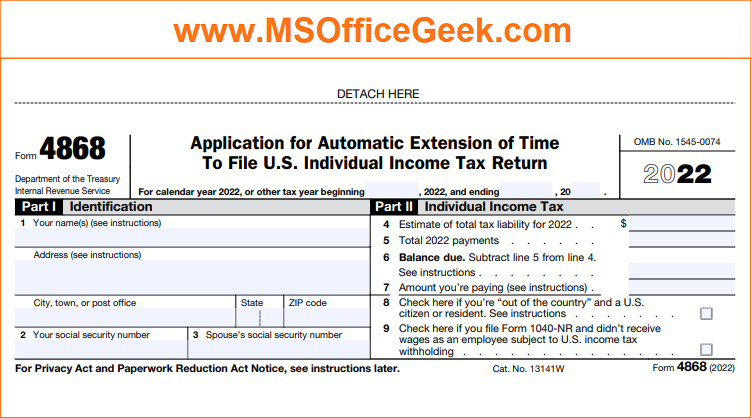

You need to file Form 4868 to obtain an extension to file your taxes. Use Free File by IRS to electronically obtain an automatic tax-filing extension.

Individual taxpayers can also obtain an extension by paying all or part of their estimated income tax by specifying that the payment is being made for an extension.

You can use Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or even your credit/debit card. Under this option, you don’t need to fill out form 4868. After receiving your request, IRS sends a confirmation number to you.

Table of Contents

Download Link for IRS Form 4868 – Application for Automatic Extension To File Federal Income Tax Return 2022

Click on the button below to download IRS Form 4868 to submit your application for an Extension To File your Federal Income Tax Return 2021:

Additionally, you can also download Federal Income Tax templates like Itemized Deduction Calculator 2022, Federal Income Tax Calculator 2022, Recovery Rebate Credit Calculator, Employee Retention Credit Calculator 2021, Paycheck Calculator, and IRS Compliant Mileage Log Template 2022.

Furthermore, feel free to contact us for the customization of this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

Eligibility Criteria – Extension To File Tax

There are different rules for different filing statuses. A U.S. citizen or resident who needs an automatic extension to submit a U.S. individual income tax return can use Form 4868. This provides a maximum six-month extension to taxpayers living and working in the country.

Moreover, by default, IRS allows US Citizens or residents living abroad at the time of the due date 2 months extensions to file their returns and pay any amounts owing without filing Form 4868.

Furthermore, if these taxpayers living abroad file Form 4868 they will get an extra four months.

According to IRS, Out of the Country means:

- Anyone who resides outside of the United States and Puerto Rico, and whose primary place of employment is also outside of the United States and Puerto Rico.

- Anyone serving in the military or the navy who is stationed outside the United States and Puerto Rico.

Extension to File and Not To Pay

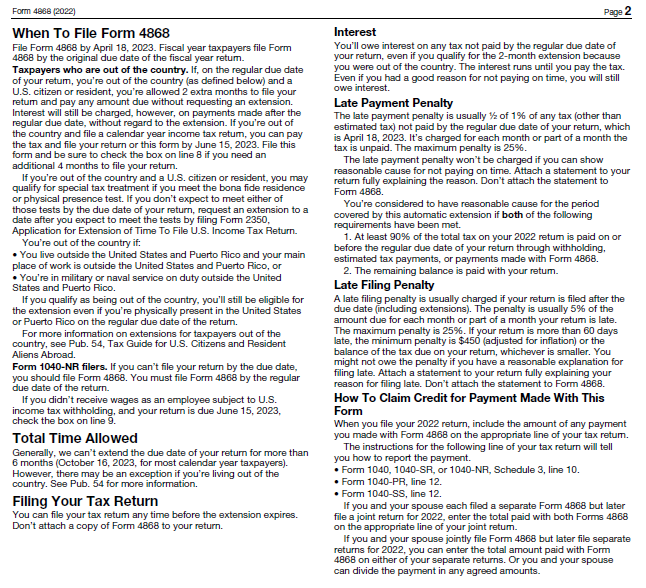

Taxpayers must understand clearly that the Form 4868 extension only extends your filing deadline, not your payment deadline. Even if the IRS granted you an extension to file later, you must still pay your taxes by the due date.

Moreover, if you anticipate you’ll owe taxes when it’s time to file your return, figure out how much you’ll owe and deduct any withholding taxes on your paycheck.

Furthermore, If estimates are high and you end up overpaying IRS reimburses the excess amount when you file your return. If you pay on the due date, you can avoid fines and interest. On the contrary, fines and interest are applicable if you underestimate your tax liability.

For getting an extension to pay, you must opt for IRS Payment Options. Click the link below for detailed information:

Tax Payments In Installments For the Year 2021

How To File Form 4868?

Extension To File Request – Online

The IRS’s electronic filing technology, IRS e-file, allows you to transmit tax forms directly to IRS computers, including Form 4868.

If you file Form 4868 electronically using IRS e-file on your own, using free or commercial tax software, or with the aid of a tax expert who utilizes e-file, you can request an automatic extension to file your tax return. In either event, you’ll get an email confirmation that you may save with your tax documents.

If your adjusted gross income (AGI) falls below a certain threshold of $73,000 in 2021 you may use brand-name software from Free File, a free service that offers federal tax preparation and e-filing choices to taxpayers.

You can utilize the IRS’s Fillable Forms tool if your income is above the threshold. Some tax software firms also offer free filing under specific circumstances.

Extension To File Request – By Mail

Paper versions of Form 4868 are also available. You may either download the form from the IRS website or fill out an order form on the IRS website to have a printed form delivered to you.

Moreover, you can also get a form by calling the IRS at (800) 829-3676. Copies may be available at your local library or post office. You can only file a paper Form 4868 if you are a fiscal-year taxpayer. Calendar Year taxpayers are not allowed to file form 4868.

Reasons for Rejection of Extention To File

Usually, the IRS grants an extension if the taxpayer files the application on time and accurately.

The rejections are due to small flaws that can be easily avoided. The major reasons are:

- Typing errors or mismatches of information with IRS records. In such cases, the IRS gives you a few days to rectify the errors and resubmit the corrected form.

- When a taxpayer submits a form with unrealistic tax liability projections. If IRS denies such projections, IRS rejects your request for an extension and chances are there that you can face a penalty.

Frequently Asked Questions

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.

Disclaimer: This article is for educational purposes only and shall not be considered as tax advice. Kindly consult a CPA or tax consultant.

Pingback: Federal Income Tax Payments In Installments For Year 2022 - MSOfficeGeek